Get It 2104 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-2104 online

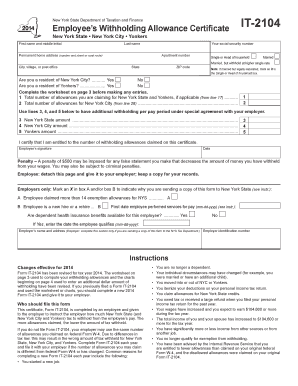

The IT-2104 form, known as the Employee’s Withholding Allowance Certificate, is an essential document for employees in New York State. It allows individuals to specify their withholding allowances for state and local taxes, ensuring that the correct amount is withheld from their paychecks.

Follow the steps to fill out the IT-2104 online.

- Press the ‘Get Form’ button to obtain the IT-2104 form and access it in your preferred document editor.

- Begin by filling out your personal information at the top of the form, including your first name, middle initial, last name, apartment number, and permanent home address including city and ZIP code.

- Enter your social security number in the specified field, making sure it is accurate to avoid any withholding errors.

- Select your filing status by marking one of the options: 'Single or Head of Household,' 'Married,' or 'Married, but withhold at higher single rate.' If married but legally separated, mark the first option.

- Indicate whether you are a resident of New York City or Yonkers by checking 'Yes' or 'No' for both questions.

- Complete the worksheet on page 3 of the form to determine your total allowances. Follow the instructions carefully to maximize your accuracy.

- Input the total number of allowances you are claiming for New York State and Yonkers, if applicable, on line 1.

- If applying for New York City allowances, enter the total on line 2.

- If necessary, specify any additional withholding per pay period on lines 3, 4, and 5 for New York State, New York City, and Yonkers respectively.

- Review all entries for accuracy and completeness, then sign and date the form.

- Detach the completed form and provide it to your employer. Retain a copy for your records.

Complete your IT-2104 form online to ensure proper tax withholding—start now!

When it comes to claiming capital allowances, you may typically go back for several tax years, depending on the applicable laws. It's essential to refer to IRS guidelines to determine the exact time frame allowed for your situation. Generally, the ability to claim past allowances helps balance your tax liabilities efficiently. For further assistance and resources, uslegalforms can help clarify your eligibility and provide the necessary forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.