Loading

Get Form 433 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 433 A online

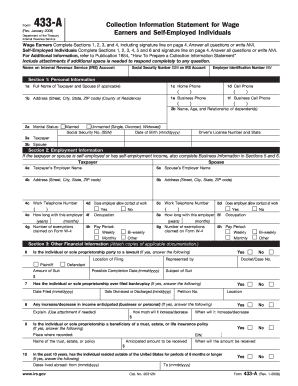

Form 433 A is a crucial document required by the IRS for evaluating the financial condition of wage earners and self-employed individuals. This guide will provide clear and supportive instructions for filling out the form online, ensuring you provide all necessary information accurately.

Follow the steps to fill out the Form 433 A online effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by completing Section 1: Personal Information. Fill in your full name, address, phone numbers, and marital status. Provide information about any dependents if applicable.

- Move to Section 2: Employment Information. Provide the names and addresses of your employer, work telephone numbers, and indicate your pay period and exemptions claimed on Form W-4.

- In Section 3: Other Financial Information, answer questions regarding any lawsuits, bankruptcies, trusts, or periods of living outside the United States. Be thorough and attach any additional documentation if necessary.

- Complete Section 4: Personal Asset Information for All Individuals. List your cash on hand, bank account details, investments, and other personal assets along with current values.

- If self-employed, finish with Sections 5 and 6: Business Information and Sole Proprietorship Information. Provide details such as business name, identification numbers, financial status, and income/expenses.

- Finally, review the form for accuracy, sign on the designated signature lines, and save your changes. You can download, print, or share the completed form as needed.

Start filling out your Form 433 A online today to ensure you have the necessary financial information ready.

Related links form

The IRS considers various factors when deciding how much to accept for an offer in compromise. This includes your income, expenses, and asset values, all of which can be reported using Form 433 A. To maximize your chances of acceptance, it is vital to provide accurate and complete financial information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.