Get 3050 0059 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3050 0059 Form online

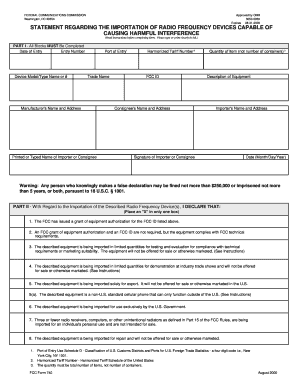

The 3050 0059 Form is essential for individuals and organizations importing radio frequency devices into the United States. Completing this form online requires attention to detail and understanding of its components. This guide provides clear and detailed instructions to assist you in filling out the form accurately and efficiently.

Follow the steps to complete the 3050 0059 Form online seamlessly.

- Click the ‘Get Form’ button to access the document. This action will allow you to open the form in the editor.

- In Part I, fill in 'Date of Entry' with the date when the device will enter the U.S. Customs territory.

- Enter the 'Entry Number' provided by the Customs Service.

- Fill in the 'Device Model/Type Name or #' to specify the particular device being imported.

- Provide the 'Port of Entry' information with the designated four-digit code of the location where the device will enter.

- Write the 'Trade Name' of the device, which is the commercial name under which it is sold.

- Enter the manufacturer's name and address to identify where the device was produced.

- Type or print the 'Printed or Typed Name of Importer or Consignee' clearly.

- Provide the 'Harmonized Tariff Number' as applicable to the item.

- Include the 'FCC ID' associated with the device.

- Manually input the 'Consignee's Name and Address' for shipping purposes.

- Indicate the 'Quantity of Item' being imported, ensuring it reflects the total number, not the number of containers.

- Describe the equipment in the 'Description of Equipment' field, providing clear details.

- Fill in the 'Importer's Name and Address,' reflecting the information of the person or organization making the import.

- Sign in the 'Signature of Importer or Consignee' section to validate the form.

- Finally, enter the 'Date' of signing, using the format Month/Day/Year.

- In Part II, indicate your declaration by placing an 'X' in the appropriate box to specify the import status.

- Review all sections for accuracy, then save changes, download, print, or share the form as needed.

Take the next step and complete your 3050 0059 Form online today.

Related links form

The California Earned Income Tax Credit (CalEITC) is available to low-income individuals and families who meet specific income criteria. To qualify, you must file a tax return, even if you do not owe taxes, and you may need to use the 3050 0059 Form for reporting purposes. This credit can significantly reduce your tax liability or even increase your refund. Check your eligibility each year, as the income thresholds may change.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.