Loading

Get Vat G 15 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat G 15 Form online

Filling out the Vat G 15 Form online can be a straightforward process when guided correctly. This guide aims to help you navigate the sections of the form, ensuring you provide accurate information to facilitate your tax deferment.

Follow the steps to complete the Vat G 15 Form online.

- Click the ‘Get Form’ button to access the form and open it in your selected editor.

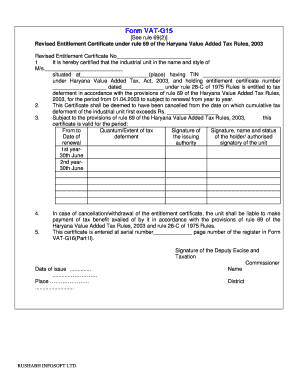

- In the first section of the form, enter the name of the industrial unit. Be sure to accurately fill in 'M/s.' followed by the name of the unit.

- Next, provide the address of the unit in the designated field. Ensure that you include the full address, including the place name.

- Fill in the Tax Identification Number (TIN) of the industrial unit. Double-check to confirm that the TIN is correct as it is essential for processing.

- Enter the entitlement certificate number and the date associated with this certificate. It is important to ensure that this information matches your records.

- Indicate the cumulative tax deferment threshold, stating the amount beyond which the certificate will be deemed canceled.

- Specify the validity period of the certificate. Clearly enter the start and end dates of this period.

- In the next fields, note the quantum or extent of the tax deferment. This should align with the financial details of your industrial unit.

- After filling in all required fields, ensure that you provide the signature of the authorized signatory. Include their name and status for clarity.

- Finally, review all information for accuracy. Save your changes, and choose whether to download, print, or share the filled form as per your requirements.

Complete your Vat G 15 Form online today and streamline your tax deferment process.

While visitors to the UK won't be able to reclaim VAT on items they purchase and take home with them, any non-EU visitors who purchase items in store and have them sent directly to an overseas address will be able to reclaim VAT in line with international tax principles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.