Loading

Get T2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2011 online

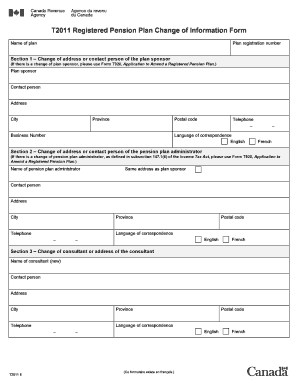

The T2011 is a crucial document for making changes to a registered pension plan. This guide provides clear instructions to help you navigate the form effectively and accurately.

Follow the steps to complete the T2011 form online.

- Click the ‘Get Form’ button to obtain the T2011 form and open it in your browser or preferred editor.

- In Section 1, provide the name of the plan and its registration number. If applicable, update the change of address or contact person of the plan sponsor, including their address, city, province, postal code, and telephone number. Indicate the preferred language of correspondence.

- Proceed to Section 2 to update the details for the pension plan administrator, including their name, address, and contact information. Mark if the address is the same as the plan sponsor’s.

- In Section 3, input the new consultant's name and their contact details. Make sure to provide complete information including address, telephone number, and language preference.

- For Section 4, fill out the information of the trustee, including their name and contact details. Ensure that the address, city, province, and postal code are correctly filled.

- In Section 5, provide the insurer’s name and address. Complete the contact information and again select the preferred language for correspondence.

- Finalize the form in Section 6 by certifying the information. An authorized representative must print their name, sign the form, and include the date and telephone number for validity.

- After reviewing all sections for accuracy, you can save changes to the form, download it, print it, or share it if necessary.

Take action now and complete your T2011 form online.

You can obtain CRA tax forms directly from the Canada Revenue Agency's website. If you are looking for specific forms like the T2011, using US Legal Forms can simplify your search and provide instant access to all necessary paperwork. This way, you can ensure that you have the right forms to meet your filing needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.