Loading

Get Usda Form Rd 449-30 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA Form RD 449-30 online

Filling out the USDA Form RD 449-30 online can be a straightforward process when approached step-by-step. This guide aims to provide clear instructions to help users successfully complete the form with confidence.

Follow the steps to complete the USDA Form RD 449-30 online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

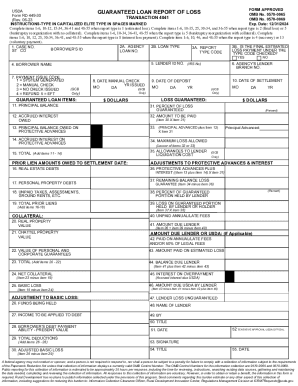

- Identify the report type by selecting the appropriate option. For estimated loss, complete items 1-6, 10-12, 15-34, 36-41, and 48-55. If reporting final loss, complete items 1-6, 10-15, 25, 30-34, and 36-55.

- Enter your case number and borrower's ID in items 1 and 4. Ensure all relevant identification numbers are accurate.

- Fill in the loan type details in sections 2A and 2B. It is crucial for categorizing the loan correctly.

- If applicable, check whether this report is for the final estimated loss in 3B. Indicate ‘Yes’ if it applies.

- Complete financial information related to the borrower in sections 11, 19, 21, and any other relevant sections specifying amounts due, principal balances, and accrued interests.

- Carefully calculate totals for loss guarantees, adjustments, and any deductions as indicated throughout the form, especially in items 34 through 39.

- Ensure that all signatures are completed in items 48 to 55, including the lender's official confirmation and USDA approval if necessary.

- At the end, save your changes, download a copy for your records, or print the form for submission.

Start filling out your USDA Form RD 449-30 online today to ensure timely processing.

ing to the U.S. Department of Agriculture, the most common reasons for a failed USDA loan application include insufficient income, debt-to-income ratios that are too high, and credit history or score issues. A study conducted in 2020 found that 24% of USDA loan applications were denied due to credit score issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.