Loading

Get Form 45 106f3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 45 106f3 online

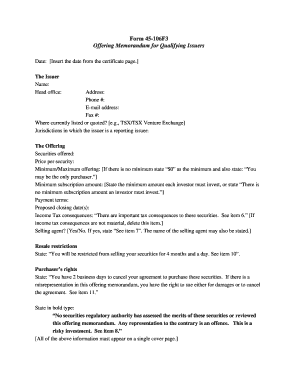

Filling out the Form 45 106f3, also known as the Offering Memorandum for Qualifying Issuers, is an important step for issuers looking to provide information to potential investors. This guide offers a clear and supportive approach to help you complete the form accurately and efficiently.

Follow the steps to complete your Form 45 106f3 online.

- Press the ‘Get Form’ button to access the form. This will allow you to open it in your chosen editor.

- Begin with the Issuer section. Enter the name of the issuer and provide the head office address, phone number, email, and fax number. Specify where the issuer is currently listed or quoted.

- In the Offering section, detail the securities being offered. Include the price per security, minimum and maximum offering amounts, and necessary payment terms.

- Provide a detailed breakdown of how the net proceeds will be used in the Use of Net Proceeds section. Make sure to mention any possible reallocation of funds and disclose any working capital deficiencies.

- In Information About the Issuer, include a brief business summary and specify any existing documents incorporated by reference. Ensure the information is presented clearly.

- Populate the Directors and Executive Officers section with relevant details about key individuals in the issuer’s governance.

- Provide information regarding the Capital Structure of the issuer, detailing the number of outstanding securities and any additional relevant terms.

- In the Securities Offered section, describe the material terms associated with the securities being offered and outline the subscription procedure.

- Address the Income Tax Consequences and RRSP Eligibility. Recommend users consult with their professionals for tailored advice.

- Highlight any compensation paid to sellers and finders, and include relevant details on risk factors associated with the investment.

- Complete the Reporting Obligations and Resale Restrictions sections per the guidelines, ensuring adherence to local regulations.

- Finally, review and validate all details within the Purchasers' Rights and Date and Certificate section. Ensure the certificate is signed by required officers.

- Upon completion, users can save changes, download the form, print it, or share it as needed.

Start filling out your Form 45 106f3 online today to provide potential investors with crucial information.

Related links form

The offering memorandum prospectus exemption allows an issuer to sell its securities to a wider range of people than typically allowed for private placements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.