Get Vanguard Inherited Ira Application For Nonspouse Beneficiaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vanguard Inherited IRA Application for Nonspouse Beneficiaries online

Navigating the financial responsibilities following the loss of a loved one can be challenging. This guide aims to provide clear and supportive instructions on how to properly complete the Vanguard Inherited IRA Application for Nonspouse Beneficiaries online, ensuring that the transfer of IRA assets is handled effectively.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to retrieve the Vanguard Inherited IRA Application form and open it in your preferred online editor.

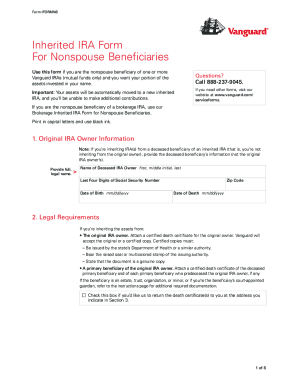

- Complete Section 1 by providing the original IRA owner's full legal name, the last four digits of their Social Security number, their date of birth, and the date of death.

- In Section 2, input the required legal documents. Attach a certified death certificate and check the box if you wish to have these documents returned to you.

- Fill out Section 3 with your information as the nonspouse beneficiary. Provide your full legal name, birth date, email address, and contact numbers. Check the appropriate box if you are a minor or if the beneficiary is a trust, estate, or organization.

- If applicable, complete Section 4, providing details of the custodian or guardian responsible for the minor or incapacitated individual.

- In Section 5, designate primary and secondary beneficiaries for the inherited IRA. Ensure that the total percentage equals 100% for clarity.

- Read the important information provided in Section 6 regarding the terms of opening a new account and sign the form verifying that all information is accurate.

- If your name has changed, complete Section 7 to verify the name change and obtain a signature guarantee.

- Make a copy of the completed form for your records. Mail the form and all required documents in the provided postage-paid envelope, or to the specified address.

- Review all the provided information, ensure accuracy, and submit the form along with any attached documents.

Complete your Vanguard Inherited IRA Application for Nonspouse Beneficiaries online today to ensure a smooth transition.

Related links form

An eligible designated beneficiary at Vanguard includes certain individuals who can inherit an IRA and receive favorable tax treatment. This group typically consists of spouses, minor children, and individuals who are disabled or chronically ill. Understanding who qualifies is essential when navigating the Vanguard Inherited Ira Application For Nonspouse Beneficiaries, as it influences how you manage the inherited funds.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.