Loading

Get Nz Ir 526 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ IR 526 online

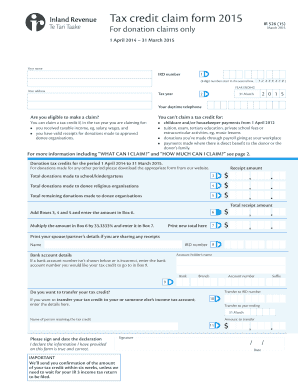

Filling out the NZ IR 526 form for claiming donation tax credits can seem daunting, but with careful attention to detail, you can complete it successfully online. This guide will provide you with a clear, step-by-step approach to help you navigate each section of the form.

Follow the steps to complete your tax credit claim.

- Press the ‘Get Form’ button to access the NZ IR 526 form and open it in your online editor.

- Enter your name and IRD number. Ensure that your IRD number is an 8-digit number starting in the second box.

- Fill in your address and specify the tax year you are claiming i.e., for the period ending on 31 March 2015.

- Provide your daytime telephone number for any inquiries related to your claim.

- Indicate your eligibility to claim by reviewing the criteria provided in the form. You can only claim if you received taxable income and have valid receipts for donations.

- List the amounts for donations made. Fill in Box 3 for donations made to schools and kindergartens, Box 4 for donee religious organisations, and Box 5 for remaining donations to donee organisations.

- Calculate the total donation amount by adding Boxes 3, 4, and 5, and enter this amount in Box 6.

- Multiply the amount in Box 6 by 33.3333% and enter the result in Box 7.

- If sharing receipts with a spouse or partner, fill in their details in Box 8.

- Provide your bank account details in Box 9, ensuring accuracy for the transfer of your tax credit.

- If transferring your tax credit, fill in the recipient's IRD number and specify the amount to be transferred in Boxes 10 and 11.

- Sign and date the declaration to confirm that the information you have provided is true and correct.

- Attach all donation receipts received between 1 April 2014 and 31 March 2015 as instructed at the end of the form.

- Once completed, save your changes and proceed to download, print, or share the form as needed.

Complete your donation tax credit claim form online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The tax credit form you need for donations in New Zealand is the NZ IR 526. This form is essential for claiming your tax credits for charitable donations made throughout the year. Ensure that you gather all necessary documentation to facilitate the process. By completing this form accurately, you can optimize your tax return, benefiting both you and the charities you support.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.