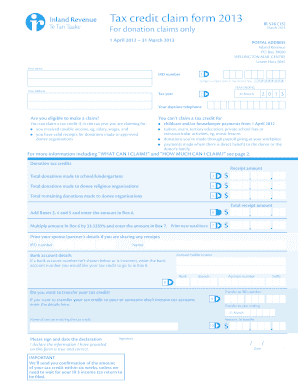

Get Nz Ir 526 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NZ IR 526 online

How to fill out and sign NZ IR 526 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Enterprise, lawful, fiscal, and additional electronic documents necessitate a sophisticated level of adherence to regulations and safeguarding. Our files are consistently refreshed in accordance with the most recent statutory modifications.

Additionally, with us, all the information you submit in your NZ IR 526 is securely safeguarded against leaks or harm through industry-leading file encryption.

Our platform allows you to manage the entire procedure of filling out legal forms online. Consequently, you save hours (if not days or weeks) and eliminate extra costs. Now, complete the NZ IR 526 from your residence, business office, or while traveling.

- Access the document in the feature-rich online editing tool by clicking on Get form.

- Fill in the required fields highlighted in yellow.

- Click the arrow labeled Next to navigate between fields.

- Utilize the e-signature feature to affix an electronic signature to the form.

- Enter the pertinent date.

- Review the entire document to ensure nothing has been overlooked.

- Click Done and download the completed document.

How to modify Get NZ IR 526 2013: personalize forms online

Streamline your document creation process and tailor it to your preferences within moments. Fill out and authorize Get NZ IR 526 2013 with a robust yet user-friendly online editor.

Handling paperwork is frequently challenging, especially when you deal with it sporadically. It requires you to strictly follow all procedures and accurately fill in all fields with complete and precise details. However, it often occurs that you may need to alter the document or add additional fields to fill in. If you need to refine Get NZ IR 526 2013 before submitting it, the easiest method is to utilize our powerful yet simple online editing tools.

This extensive PDF editing tool allows you to swiftly and effortlessly complete legal documents from any device connected to the internet, make basic amendments to the template, and insert additional fillable fields. The service lets you choose a specific area for each type of data, such as Name, Signature, Currency, and SSN, among others. You can set them as mandatory or conditional and designate who should fill out each field by assigning them to a defined recipient.

Follow the steps below to enhance your Get NZ IR 526 2013 online:

Our editor is a flexible multi-functional online solution that can assist you in quickly and effortlessly adjusting Get NZ IR 526 2013 along with other forms to fit your needs. Decrease document preparation and submission duration while ensuring your paperwork appears flawless without any stress.

- Access the required template from the directory.

- Complete the gaps with Text and use Check and Cross tools in the tickboxes.

- Utilize the right-side toolbar to modify the form with new fillable areas.

- Select the fields according to the type of information you want to collect.

- Set these fields as mandatory, optional, and conditional and arrange their order.

- Assign each section to a particular individual using the Add Signer feature.

- Ensure that you’ve made all the necessary adjustments and click Done.

Get form

To claim back on donations in NZ, you must retain proper documentation of your contributions and file your claims on the relevant forms. Understanding the NZ IR 526 framework will ensure you accurately report your donations and potentially receive a tax refund. It’s essential to follow these guidelines for a successful claim.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.