Get Form No. Apt4 - Revenue Commissioners - Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form No. APT4 - Revenue Commissioners - Revenue online

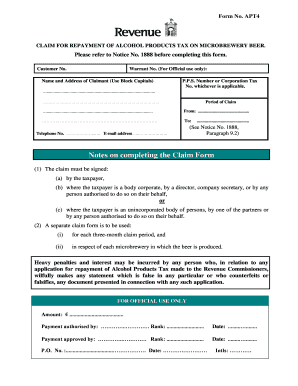

Filling out Form No. APT4 is essential for claiming a repayment of alcohol products tax on microbrewery beer. This guide provides clear and detailed instructions to assist users in completing the form accurately for online submission.

Follow the steps to successfully complete Form No. APT4.

- Press the ‘Get Form’ button to download the form and access it in your preferred document editor.

- Enter your customer number at the top of the form. This is a unique identifier that associates you with your claims.

- Identify and enter the warrant number, which is designated for official use only, as instructed.

- Fill out the name and address of the claimant using block capitals for clarity.

- Include the relevant P.P.S. number or Corporation Tax number, depending on what applies to your claim.

- Specify the period of claim by entering the start and end dates clearly.

- Provide your telephone number and email address for any necessary follow-up communication.

- Complete the claim schedule section by documenting the name and address of the microbrewery where the beer was brewed.

- Indicate the quantity of beer previously claimed in the current calendar year in hectolitres.

- Input the quantity of beer that is the subject of this claim, also in hectolitres.

- Calculate and enter the total quantity of beer claimed to date, which is the sum of the previous two quantities.

- Document the total amount of alcohol products tax paid regarding the beer quantity stated in the claim.

- Provide the serial numbers and dates of payment documents related to the claim period.

- At this stage, calculate the amount of repayment claimed, which should be 50% of the amount shown in the previous field.

- Read through the declaration carefully, ensuring that all the conditions are met, and fill in the required details.

- Sign and date the form, ensuring all information provided is accurate to the best of your knowledge.

- Review your completed form for correctness before saving the changes, downloading, printing, or sharing as needed.

Complete your form online today to ensure a smooth claim process.

Related links form

Individuals who earn income outside of standard employment, such as freelancers or business owners, must file Form 11 revenue. This form is essential for reporting income to the Revenue Commissioners and ensuring compliance with tax obligations. If you have received rental income, investment income, or any other form of earnings, you will likely need to file this form. Utilize uslegalforms to simplify your filing process with Form No. APT4 - Revenue Commissioners - Revenue.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.