Loading

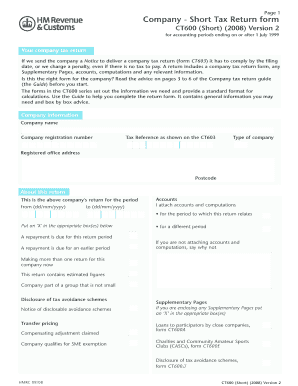

Get Ct600 (short) (2008) Version 2 Short Version Of Company Tax Return Form. Value-added Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the CT600 (Short) (2008) Version 2 Short Version Of Company Tax Return Form. Value-Added Tax online

The CT600 (Short) (2008) Version 2 is a vital document for companies to submit their tax return information to HMRC. This guide provides clear instructions on how to complete the form accurately and efficiently, ensuring compliance with filing requirements.

Follow the steps to fill out the CT600 (Short) (2008) form effectively.

- Click the ‘Get Form’ button to acquire the form and open it in your document management tool.

- Fill in the company information section with your company's name, registration number, and tax reference as indicated on the CT603 form. Ensure all details match your official documentation.

- Indicate the accounting period the return covers by entering the start and end dates in the 'About this return' section.

- Attach the necessary accounts and computations that align with the reporting period. If not attaching accounts, provide an explanation in the designated area.

- Proceed to the Company tax calculation section. Enter the total turnover from trade in the respective box, followed by trading and professional profits, ensuring accurate figures are reported.

- Document any losses carried forward, net trading profits, and additional income such as bank interest or profits from non-trading relationships. Sum and record these in the corresponding boxes.

- Complete the deductions and reliefs section, noting all management expenses and any non-trade capital allowances to determine profits chargeable to corporation tax.

- Calculate the tax based on applicable rates and report the total corporation tax, including any marginal reliefs if applicable.

- Provide details for any repayments due and bank information relevant for direct credit. Ensure to fill out the payment authority if the repayment is to be made to a third party.

- Finish by signing the declaration section, confirming that all information provided is true and complete. Include your name in capitals and your status.

Complete your CT600 (Short) (2008) form online today to ensure timely submission and compliance.

Yes, you can file a short year tax return if your company’s accounting period is less than 12 months. In such cases, the CT600 (Short) (2008) Version 2 Short Version Of Company Tax Return Form. Value-Added Tax can still be used. Make sure to indicate your accounting period correctly for accurate tax calculations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.