Loading

Get Co Op Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Co Op Questionnaire online

This guide provides a clear and supportive approach to filling out the Co Op Questionnaire online. Follow these instructions to ensure that you complete each section accurately and efficiently.

Follow the steps to complete your Co Op Questionnaire online.

- Click 'Get Form' button to obtain the Co Op Questionnaire and open it in your preferred editor.

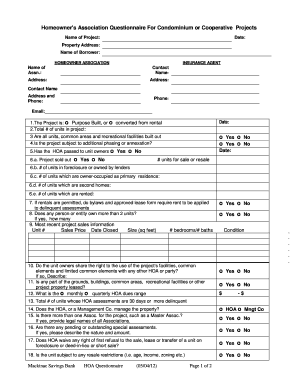

- Begin by entering the name of the project, date, and property address in the designated fields.

- Provide the name of the borrower along with the homeowner association details, including the association name, contact person, address, phone number, and email.

- Indicate the type of project by selecting whether it is purpose built or converted from rental. Then, enter the total number of units in the project.

- Answer the questions regarding the current status of units, including if the project is fully built out and if it is subject to additional phasing or annexation.

- Provide information on the board of unit owners and the number of units for sale or resale, foreclosures, primary residences, second homes, and rentals.

- Explain if rentals are permitted, and if the bylaws require rent to be applied to delinquent assessments.

- Detail any ownership by a single entity of more than two units and include recent project sales information.

- Specify whether unit owners share rights to common facilities with any other HOA or entity, and describe any leased grounds or buildings.

- Indicate the range of HOA dues and the number of units whose assessments are delinquent.

- Clarify if the HOA or a management company manages the property, and whether there are multiple associations for the project.

- Address any pending special assessments, resale restrictions, and specific ownership and mortgage responsibilities.

- Complete the sections regarding insurance coverage, with details for general liability, property, fidelity bond, and windstorm insurance.

- List the number of insured buildings, the ID of the building where the unit is located, and specific characteristics of the building.

- Confirm the HOA's involvement in any litigation and any adverse environmental hazards affecting the project.

- Select the style of the project and ensure that you include all necessary supporting documents marked with an 'X'.

- Finally, certify that the information provided is true and correct by filling out the certification section with company name, signature, title, printed name, date, phone number, fax number, and email.

- Once the form is complete, save changes, download, print, or share the form as needed.

Complete your Co Op Questionnaire online today to ensure a smooth process.

Coop assessments are evaluations performed by the co-op board to determine an applicant's suitability for membership. These assessments consider financial health, background checks, and other relevant factors. They help ensure that all residents align with the co-op’s values and community standards. For a smooth experience, familiarize yourself with the assessment criteria before applying.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.