Loading

Get Taxes Phd Organizer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxes PhD Organizer online

Filling out the Taxes PhD Organizer online is a straightforward process that helps users organize and prepare their tax information efficiently. This guide provides clear, step-by-step instructions to ensure you complete the form accurately.

Follow the steps to complete the Taxes PhD Organizer effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

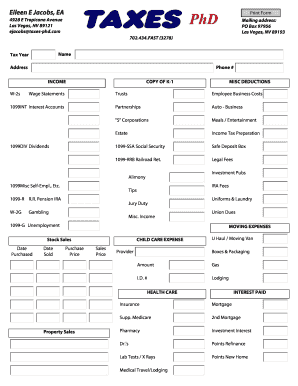

- Begin by entering your name, tax year, and address in the designated fields. Ensure that all information is current and accurate.

- Provide your phone number in the relevant section to ensure easy communication if needed.

- In the 'Income' section, list all sources of income such as W-2s, 1099 forms for interest and dividends, and any other relevant income details. Be thorough to avoid omissions.

- Fill in the 'Misc Deductions' area with any applicable deductions you may have, including jury duty pay, gambling winnings, and uniforms.

- Record any moving expenses in the provided fields, detailing dates, amounts, and providers.

- Complete the 'Health Care' section with relevant medical expenses, including insurance and doctor visits.

- In the 'Taxes Paid' section, enter information about sales tax, state income tax, and real estate tax paid during the year.

- If applicable, document non-cash contributions and ensure to note any requirements for receipts over $500.

- Scroll to the 'Estimated Taxes Paid and Credits' section to report any prior year overpayments and estimated taxes for the current year.

- Review all sections carefully for any errors or incomplete fields before finalizing your form.

- Once all information is completed and reviewed, save your changes. You may then download, print, or share the completed form as needed.

Start filling out your Taxes PhD Organizer online today for a seamless tax preparation experience.

PhD stipends are generally considered taxable income by the IRS. Depending on the structure of your funding, you may not have taxes withheld from your stipend payments, which means you should prepare for potential tax liability. The Taxes PhD Organizer can help you prepare for this by organizing your stipend details and estimating your tax burden effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.