Loading

Get Form St 18

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form St 18 online

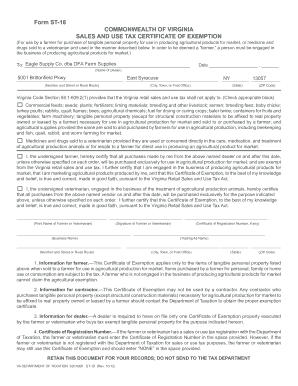

The Form St 18 is a sales and use tax certificate of exemption for farmers and veterinarians in Virginia. This guide will help you understand how to fill out the form accurately and effectively online.

Follow the steps to complete the Form St 18 online.

- Press the ‘Get Form’ button to obtain the form and access it in your document editor.

- Enter the dealer's name in the appropriate field.

- Fill in the date of the transaction in the designated space.

- Provide the complete address of the dealer including the street number, city, state, and ZIP code.

- Check the appropriate boxes to indicate the items being purchased that are exempt from sales tax.

- Certify your status as a farmer or veterinarian by signing the document and printing your name.

- If applicable, include your Certificate of Registration Number or write 'NONE' if you are not registered.

- Finally, ensure that all information is accurate, then save changes, download, print, or share the filled form as required.

Complete your Form St 18 online today for a smooth filing experience.

Related links form

To reprint a tax exemption certificate, locate your original Form ST 18. If you cannot find it, you may need to request a duplicate from the issuing agency. Many state agencies allow you to reprint the form directly from their website. For convenience, US Legal Forms also offers templates that can help you recreate your Form ST 18 quickly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.