Loading

Get Iht407

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht407 online

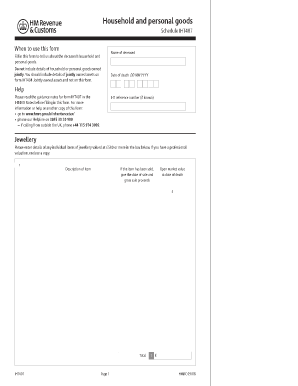

The Iht407 form is essential for reporting the household and personal goods of a deceased person. This guide will help you understand how to fill it out accurately and efficiently online.

Follow the steps to complete the Iht407 form online.

- Click ‘Get Form’ button to access the Iht407 document and open it in your editing interface.

- Begin by entering the name of the deceased in the specified field. Ensure you have accurate information to avoid delays later.

- Input the date of death in the format of DD MM YYYY. Correctly filling in this field is crucial for the validity of your submission.

- If you have the IHT reference number, include it in the designated area. This helps link the form to the deceased's record.

- Section on jewellery: Enter details of individual items valued at £500 or more, including descriptions and market values at the date of death. If sold, include the date of sale and gross sale proceeds.

- Next, detail vehicles, boats, and aircraft by including their manufacturer, model, year, registration number, condition, and market value. Follow the same procedure for sale information if applicable.

- In the antiques, works of art, or collections section, provide descriptions and value details similar to previous sections. Remember to mention any professional valuations.

- Fill in the total value of other household and personal goods not already listed, such as lower-value items or furniture. No need to list these individually.

- Indicate whether any of the items listed in box 4 were included in the deceased's household insurance policy. If yes, be sure to attach a copy of the policy.

- Finally, calculate the total value of all household and personal goods (sum of boxes 1, 2, 3, and 4) and include it in the summary section.

- Once all fields are complete, save your changes. You may then download, print, or share the Iht407 form as needed.

Complete your Iht407 form online today and ensure all necessary information is accurately reported.

Related links form

Filling out a living trust involves creating a legal document that outlines how your assets will be managed during your lifetime and distributed after your death. You should detail the assets included in the trust, designate beneficiaries, and appoint a trustee. For guidance, consider using platforms like US Legal Forms to ensure you have the correct documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.