Loading

Get Mo W 401 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo W 401 2012 Form online

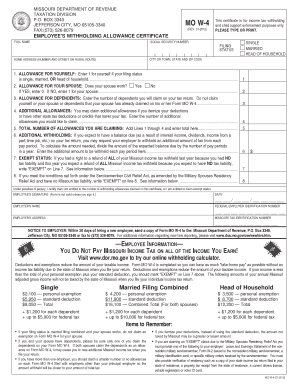

This guide provides detailed instructions on how to fill out the Mo W 401 2012 Form online. By following these steps, you can ensure that your form is completed accurately and efficiently.

Follow the steps to complete the Mo W 401 2012 Form online easily

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by inputting your full name in the designated field on the form.

- Enter your social security number in the specified box to identify your tax records.

- Fill in your home address, including number and street, city or town, state, and zip code.

- Select your filing status by marking either 'Single', 'Married', or 'Head of Household' as applicable.

- In line 1, enter 1 for yourself based on your chosen filing status.

- In line 2, answer the question regarding your spouse's employment. If your spouse works, enter 0; if not, enter 1.

- In line 3, indicate the number of dependents you will claim on your tax return.

- If eligible, enter additional allowances on line 4 based on deductions or credits you plan to claim.

- Calculate the total number of allowances and write the sum on line 5 after adding lines 1 through 4.

- If you expect any additional tax due, specify the amount on line 6 for increased withholding.

- For lines 7 and 8, follow the criteria outlined in the instructions to determine if you qualify for exempt status and write 'EXEMPT' if applicable.

- Sign and date the form to affirm the accuracy of the information provided.

- Finally, review all provided information for correctness, then save, download, print, or share the completed form as needed.

Complete your Mo W 401 2012 Form online today to ensure timely and accurate tax withholding.

Related links form

In Missouri, state tax withholding rates depend on your income level and filing status. Generally, the rate ranges from 1.5% to 5.4%. It's vital to consult the latest state guidelines to determine the precise percentage that applies to you. The Mo W 401 2012 Form helps ensure that your withholdings align with these regulations, minimizing potential underpayment or overpayment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.