Loading

Get Ferpta

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ferpta online

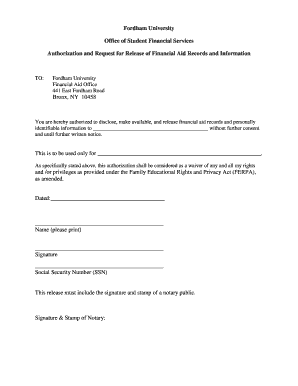

The Ferpta is a crucial document that authorizes the sharing of financial aid records and personally identifiable information. Completing this form online can streamline the process of managing your financial aid information.

Follow the steps to complete the form effectively.

- Click the 'Get Form' button to access the Ferpta document and open it in your digital workspace.

- In the designated field, enter the name of the person authorized to receive your financial aid records. Ensure the spelling is accurate to avoid issues.

- Specify the purpose for which this authorization is being granted in the corresponding section. Be clear and concise, as this information is important for record-keeping.

- Review the statement regarding your rights under the Family Educational Rights and Privacy Act (FERPA). Confirm that you understand this waiver of rights.

- Fill in the date when you are completing this form to ensure it is current.

- Print your name clearly in the space provided to ensure your identity is easily recognized.

- Sign the form in the signature field, confirming your consent for the release of the information.

- Provide your Social Security Number (SSN) carefully, as this will be used to identify your records accurately.

- Ensure that the release form is signed and stamped by a notary public to validate the authorization.

- After completing all sections, save your changes, and consider downloading, printing, or sharing the document as needed.

Complete your Ferpta authorization online today to efficiently manage your financial records.

Related links form

The FIRPTA forms are primarily filled out by the buyer of the property, as they are responsible for withholding the required tax. However, sellers should also be involved in ensuring that the information provided is accurate. Both parties must understand their roles under the Ferpta regulations to avoid issues. Utilizing services like US Legal Forms can clarify these responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.