Get Irs 940 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

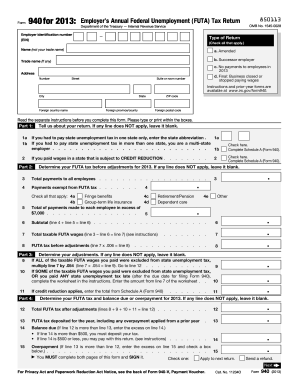

How to fill out the IRS 940 online

Filling out the IRS 940 form online is an essential process for employers reporting their annual federal unemployment tax liability. This guide will walk you through each step to ensure accurate completion of the form and compliance with federal guidelines.

Follow the steps to complete your IRS 940 form.

- Click the ‘Get Form’ button to acquire the form and access it in the editor.

- Begin by entering your employer identification number (EIN) at the designated field. This unique identifier is crucial for processing your tax return.

- Provide your name and any trade name if applicable. Ensure that your address is accurately filled out, including street number, suite number, city, state, and ZIP code.

- In Part 1, report payments made to employees. Complete lines thoughtfully, including entering states where unemployment tax was paid, if applicable. If you are a multi-state employer, ensure you note that.

- Move on to Part 3 and calculate any adjustments. If applicable, refer to the instructions for specific calculations regarding any state unemployment tax credits or reductions.

- If your FUTA tax liability exceeds $500, proceed to Part 5. Report your FUTA tax liability by quarter.

- Once everything is filled out, you can save your changes, download, and print the form for your records, or share it with necessary parties.

Start filling out your IRS 940 form online today to ensure compliance and timely submission.

Get form

If you want to file an IRS 940 without a payment, you can file it directly to the IRS either by mail or electronically. For electronic filing, you may use the IRS e-file system or authorized e-filing software. For paper filing, send it to the appropriate address listed in the IRS instructions for Form 940. At US Legal Forms, you can find additional resources and forms to assist you in your filing process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.