Loading

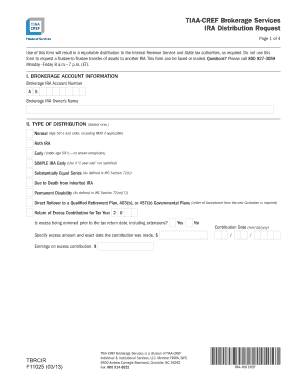

Get Use Of This Form Will Result In A Reportable Distribution To The Internal Revenue Service And State

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Use Of This Form Will Result In A Reportable Distribution To The Internal Revenue Service And State online

Completing the Use Of This Form Will Result In A Reportable Distribution To The Internal Revenue Service And State is an important step in managing your IRA distributions. This guide will provide clear instructions on each section of the form, ensuring that users of all experience levels can navigate the process effectively.

Follow the steps to successfully fill out your form.

- Press the ‘Get Form’ button to access the needed form and open it in your designated online editor.

- Enter your brokerage IRA account number in the specified field under the brokerage account information section.

- Provide the brokerage IRA owner’s name exactly as it appears in your records.

- In the type of distribution section, select one option that best describes your situation, such as Normal, Roth IRA, or Early distribution.

- If applicable, indicate whether you are requesting the return of excess contributions. Specify the excess amount and the contribution date.

- Choose a delivery method for your distribution, selecting from options such as mailing a check, overnight check request, or ACH transfer.

- In the distribution instruction section, choose whether to request a total or partial distribution, including entering the specific cash amount if applicable.

- Make your tax withholding elections for both federal and state income tax. Note the consequences of not making an election.

- Sign and date the form in the signature section, ensuring that the date is within 30 days of receipt.

- Finally, save any changes made to the form online, and choose whether to download, print, or share the completed form as necessary.

Take control of your financial future by filling out the necessary documents online today.

Related links form

You will enter your IRA deduction on Form 1040, specifically on the designated line for IRA deductions. Following the provided guidelines is crucial because the use of this form will result in a reportable distribution to the Internal Revenue Service and state. Properly claiming your deduction helps reduce your taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.