Get Substitute W 9 Dierct Deposit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Substitute W 9 Direct Deposit Form online

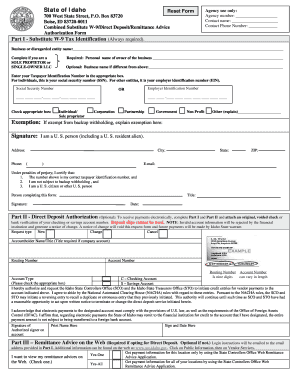

Filling out the Substitute W 9 Direct Deposit Form online is a straightforward process that helps ensure your payments from the State of Idaho are handled efficiently. This guide will provide you with clear, step-by-step instructions on how to complete each section of the form accurately.

Follow the steps to complete the Substitute W 9 Direct Deposit Form online.

- Click ‘Get Form’ button to access the Substitute W 9 Direct Deposit Form online.

- In Part I, provide your business or disregarded entity name. If you are a sole proprietor or a single-owner LLC, also include your personal name.

- Enter your Taxpayer Identification Number. If you are an individual, provide your social security number; if you are a business entity, use your employer identification number.

- Select the appropriate box that identifies your status: Individual/Sole proprietor, Corporation, Partnership, Government, Non Profit, or Other. If you are exempt from backup withholding, specify the exemption.

- Complete the contact information including your address, phone number, city, state, ZIP code, and email address.

- Sign and date the form, certifying under penalties of perjury that the information provided is accurate.

- If opting for direct deposit, complete Part II by providing your account holder name, routing number, and account number. Ensure you attach an original voided check or bank verification, as deposit slips are not acceptable.

- Specify the request type as new, change, or cancel regarding the direct deposit.

- In Part III, follow the instructions regarding web remittance advices, deciding whether you want to access payment information for individual or all locations.

- After completing all necessary fields, review your entries for correctness. Once confirmed, save changes, download, print, or share the form as needed.

Complete your Substitute W 9 Direct Deposit Form online today to ensure prompt receipt of your payments.

A W9 form is used primarily for tax purposes, allowing businesses and individuals to provide their taxpayer identification information. This form helps entities report income and payments made to you to the IRS. It is essential when establishing payment relationships and for clients who plan on making regular payments. Utilizing a Substitute W 9 Direct Deposit Form can streamline this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.