Loading

Get Local Property Form - I.s. (initial Statement) - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Local Property Form - I.S. (Initial Statement) - State Of New Jersey - State Nj online

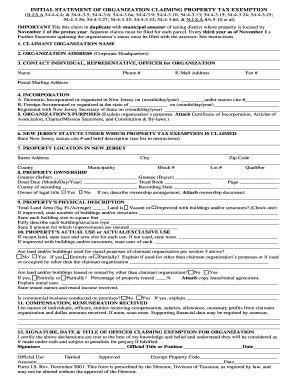

Filling out the Local Property Form - I.S. is an essential step for organizations seeking property tax exemption in New Jersey. This guide will walk you through the process of completing the form online, ensuring you provide all required information accurately.

Follow the steps to fill out the form correctly and efficiently.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Provide the claimant organization name in the designated field.

- Fill out the organization address, ensuring you include the complete corporate headquarters information.

- Complete the contact individual section with the representative's name, phone number, email address, fax number, and postal mailing address.

- Indicate whether the organization is domestic or foreign. Fill out the incorporation information, including date and statute cite.

- Describe the organization’s purposes in detail and attach relevant documents such as the Certificate of Incorporation.

- Specify the New Jersey statute under which the property tax exemption is claimed.

- Enter the property location details — street address, city, zip code, county, municipality, block number, lot number, and qualifier.

- Detail the property's ownership information, stating whether the legal title is held by the claimant organization and including deed information.

- Describe the property's physical characteristics, including land area, whether it is vacant or improved, building sizes, and insurance amounts.

- Explain the actual use of the property, including whether it is used for the organization's stated purposes.

- List any compensation or remuneration received by individuals from the claimant organization, or state if none is received.

- Ensure to sign the form, providing date and title, certifying the information is true.

- Once completed, save changes, and choose whether to download, print, or share the form as necessary.

Complete your forms online to streamline the process and ensure timely submissions.

The best evidence to protest property taxes includes comparable property sales data, appraisals, and documentation of any property improvements or damages. Presenting clear and factual information will strengthen your case during a tax appeal. Utilizing legal documents such as the Local Property Form - I.S. (Initial Statement) - State Of New Jersey - State Nj can also support your argument.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.