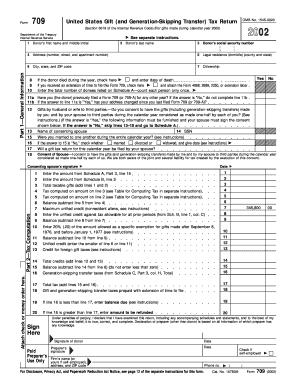

Get 2002 Fillable Form 709

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2002 Fillable Form 709 online

Filling out the 2002 Fillable Form 709 online can streamline the process of reporting gifts and generation-skipping transfers. This guide provides comprehensive instructions to navigate each section of the form effectively, ensuring that all relevant information is accurately submitted to avoid any complications.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to access and open the form in your preferred online editor.

- Begin by filling out Part 1—General Information. Enter the donor's first name, middle initial, last name, and social security number in the provided fields. Ensure that your legal residence, including county and state, as well as your complete address, are accurately noted.

- Indicate your citizenship status and note if the donor passed away during the year. If applicable, check the box to confirm if an extension to file has been received, and attach the necessary documentation.

- Complete questions related to prior filings of Form 709 and consent to gift splitting with your spouse if relevant. Fill out the necessary details and ensure both signatures are provided where required.

- Move on to Part 2—Tax Computation. Enter amounts from Schedule A and Schedule B as instructed. Follow the computations laid out for determining tax liabilities based on taxable gifts.

- In Schedule A, list all taxable gifts and their respective details. Make sure each entry includes specific information such as donor’s adjusted basis and value at the date of gift.

- If needed, fill out Schedule B for gifts from prior periods. Be sure to provide details related to any unified credit against gift taxes.

- Complete Schedule C for generation-skipping transfers, entering net transfer amounts and any exemptions applicable.

- Review all sections of the form for accuracy, save your changes, and prepare to download or print the completed form.

- Finally, share the form as necessary, ensuring all required signatures are provided prior to submission.

Start completing your Form 709 online today to ensure a smooth filing process.

Many people overlook filing the 2002 Fillable Form 709 when they make sizable gifts, leading to potential penalties. Another common mistake is miscalculating gift values or not utilizing the annual exclusion effectively. Keeping thorough records and consulting a professional or a reliable resource like uLegalForms can help prevent these errors. Being proactive limits future tax complications and keeps your finances in good shape.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.