Get City Of Fulton Ky Payroll Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Fulton Ky Payroll Forms online

Filling out the City Of Fulton Ky Payroll Forms is essential for employers to report payroll taxes accurately. This guide will support you in completing these forms online, ensuring clarity and compliance with local regulations.

Follow the steps to successfully complete the payroll form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

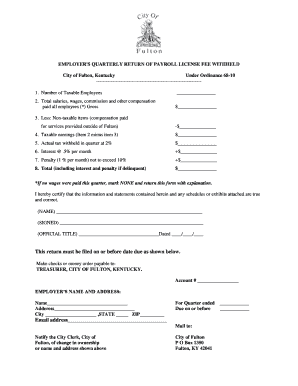

- Begin with section 1, where you will need to input the number of taxable employees. Make sure this number reflects accurately the employees for whom you are withholding taxes.

- In section 2, enter the total amount of salaries, wages, commissions, and other compensations you have paid to all employees. This should represent the gross amount before any deductions.

- Proceed to section 3, where you will subtract any non-taxable items from the total compensation. This includes amounts paid for services provided outside of Fulton. Enter this non-taxable amount, ensuring it is accurate.

- In section 4, calculate the taxable earnings by subtracting the non-taxable items (item 3) from the total salaries (item 2). Enter the resulting amount.

- Section 5 requires you to enter the actual tax withheld for the quarter at a rate of 2% of your taxable earnings from section 4.

- In section 6, calculate any interest owed at a rate of 0.5% per month on overdue amounts and enter this in the designated field.

- Section 7 requires you to calculate any penalties incurred, which are 1% per month, not to exceed 10% of the total tax liability. Enter this amount here.

- Finally, in section 8, sum the total amounts, including interest and penalties if applicable. This represents your total amount owed.

- Sign and date the form in the certification area. Ensure that the name and official title are filled in as required.

- Be sure to include the employer's name, address, and account number as indicated in the form. Provide an email address for correspondence.

- Once all sections are completed, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete your payroll documentation online today to stay compliant with local regulations.

Occupational tax in Kentucky is a levy imposed on individuals or businesses earning income within the jurisdiction. This tax helps fund local services, schools, and infrastructure. If you are unfamiliar with how to complete City Of Fulton KY Payroll Forms, platforms like uslegalforms can provide valuable resources and templates. Understanding occupational taxes is essential for both employees and employers to navigate the financial landscape more effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.