Loading

Get Form 1045

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1045 online

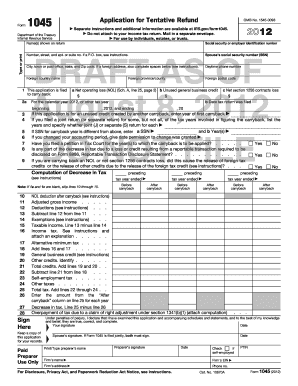

Filling out Form 1045, the Application for Tentative Refund, can feel overwhelming. This guide will provide you with clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to fill out Form 1045 online.

- Click ‘Get Form’ button to access the Form 1045 and open it in the editor.

- Begin by entering the names shown on your return in the appropriate fields. Make sure to include both your name and the partner's name if applicable.

- Enter your social security number or employer identification number. If applicable, include the spouse’s social security number as well.

- Provide your address, ensuring to fill in your city, state, and Zip code. If you are using a foreign address, complete the additional fields for foreign postal information.

- Indicate the tax year you are covering on the application by specifying the beginning and ending dates.

- Fill out the section related to the types of carrybacks you are applying for (e.g., net operating loss, unused general business credit). Make sure to write the amounts in the designated lines.

- Complete the computation of decrease in tax by following the instructions on the form lines closely, ensuring accuracy in your calculations.

- Proceed to the signature section where you, and if applicable your spouse, must sign and date the form, affirming that the information provided is true and correct.

- Once you have filled out all required fields, review your form for accuracy. You can save your changes, print, or share the completed Form 1045 as needed.

Start filling out your Form 1045 online today to ensure you meet your refund application needs.

IRS letter 1045 communicates important tax information regarding your filed Form 1045. It often includes information about the processing of your quick refund claim or any issues encountered during the process. If you receive this letter, it is crucial to review it carefully to ensure you understand your tax status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.