Loading

Get Nyc 1127 Turbotax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

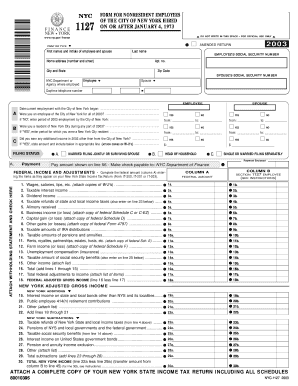

How to fill out the Nyc 1127 Turbotax online

Filling out the Nyc 1127 Turbotax online can seem daunting, but this guide will help you navigate the process step-by-step. By following these instructions, you will ensure that your form is completed accurately and efficiently.

Follow the steps to successfully complete your Nyc 1127 Turbotax online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your first names and initials along with your last name in the designated fields. Ensure accuracy in your details as these are critical for processing.

- Next, input your social security number along with your spouse's social security number, if applicable. Double-check these numbers to avoid errors.

- Fill in your home address, including street number, apartment number, city, state, and zip code. This information is necessary for identification purposes.

- Indicate the NYC department or agency where you are employed by selecting from the provided options.

- Provide your daytime telephone number, ensuring it is up to date as this may be needed for follow-up.

- Document the start date of your current employment with the City of New York. This information aids in verifying your employment timeline.

- Answer the questions regarding your status as a City employee and your residency during the tax year. Record the periods if applicable.

- Report any additional income earned in the year by indicating the amount and attaching necessary documentation such as W-2 forms.

- Complete the filing status section by selecting the appropriate category that describes your filing preference.

- Fill in the income and adjustments sections by entering the amounts as reported on your New York State Income Tax Return.

- Proceed to complete deductions by accurately filling in any itemized deductions or standard deductions, applying as directed in the instructions.

- Verify all calculations to ensure the total income, deductions, and credits are summed correctly. Check the totals on each line.

- Once you have filled out all sections, save changes in your document. You can then download, print, or share the completed form as required.

Complete your documents online today to ensure a smooth filing process.

New York City tax is separate from New York State tax, so they are calculated independently. While you will report both on your tax return, they each have different rates and regulations. It's important to understand these differences to avoid confusion and ensure compliance when using tools like TurboTax for your NYC tax calculations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.