Loading

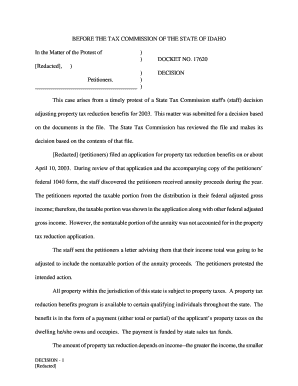

Get On The Documents In The File - Tax Idaho

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the On The Documents In The File - Tax Idaho online

Filling out the On The Documents In The File - Tax Idaho form can seem complex, especially for those unfamiliar with tax processes. This guide aims to simplify the procedure, offering detailed instructions on each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to properly fill out the form online.

- Press the ‘Get Form’ button to acquire the form and open it in your editor.

- Begin by entering your personal information, including your name, address, and social security number. Ensure that all provided details are accurate and match the records from your previous tax documents.

- In the income section, detail your federal adjusted gross income as reported on your federal tax return. If applicable, include any relevant nontaxable income such as alimony or certain annuity proceeds, as specified in Idaho Code § 63-701.

- Review additional sections that require information about other income sources, if applicable. Be thorough to ensure all qualifying income is reported.

- Complete any deductions that you may qualify for, such as unreimbursed medical expenses or funeral expenses, as stated in the guidelines.

- Check the calculations displayed to confirm that your total income and deductions are correctly entered and reflect your situation.

- Once you have reviewed the entire form for accuracy, proceed to save your changes. You may download, print, or share the completed form as required.

Complete your documents online to ensure accuracy and compliance.

1) ONLINE - Go to .irs.gov. Click "Get Your Tax Record" then choose “Get Transcript Online” and follow instructions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.