Get Ecida Business Loan Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ecida Business Loan Application Form online

Completing the Ecida Business Loan Application Form online is a critical step for businesses seeking financial assistance. This guide provides clear, step-by-step instructions to help users effectively navigate and fill out each section of the form, ensuring a smooth application process.

Follow the steps to successfully complete your loan application.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

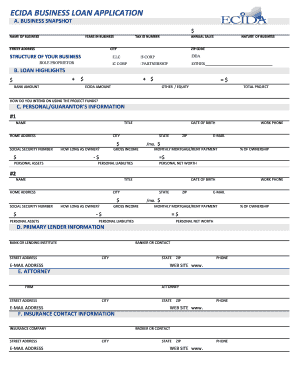

- In section A, Business Snapshot, enter your business name, years in operation, street address, tax ID number, annual sales, city, zip code, nature of business, and select the structure of your business from the provided options.

- In section B, Loan Highlights, input the bank amount, ECIDA amount, other/equity, and total project amount. Indicate how you intend to use the project funds in the designated field.

- In section C, Personal/Guarantor's Information, provide information for up to two guarantors. This includes their name, title, home address, date of birth, city, state, social security number, duration as owner, gross income, monthly mortgage/rent payment, personal assets, liabilities, and net worth.

- In section D, Primary Lender Information, fill in the details of your bank or lending institution, including the street address, banker/contact, email address, and phone number.

- In section E, Attorney, enter the name of the law firm, attorney’s name, street address, city, state, email address, zip code, phone number, and website.

- In section F, Insurance Contact Information, provide the name of the insurance company, street address, broker/contact details, email address, city, state, zip code, website, and phone number.

- In section G, Business Information, check off the documents you are attaching or have provided to your bank, including business history, ownership, management personnel, product description, competitors, market area, key accounts, primary suppliers, union relationships, description of facilities, employment impact, and accounting professional info.

- In section H, Financial Information, ensure you attach financial statements for the last three years, your federal tax returns, interim financial statements, shareholders' personal financial statements, and a credit authorization letter.

- In section I, Projections, indicate whether you are providing three years of projected profit and loss statements and balance sheets, along with any other necessary financial information.

- In section J, Signatures, sign and date the application, acknowledging the nonrefundable fees and the authorization for your bank to release documentation related to the loan request.

- Finally, review the completed application, making any necessary edits. Save changes, download, print, or share the application as needed.

Begin filling out your Ecida Business Loan Application Form online today to take the next step for your business.

The loan amount available for a new LLC can vary widely based on factors such as creditworthiness, financial history, and the type of loan. Generally, new businesses can secure anywhere from a few thousand to several hundred thousand dollars. To determine the specifics, complete the Ecida Business Loan Application Form and consult with your lender for tailored advice. This approach will give you clearer insights into your financing options.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.