Get 1098 T Hampton University

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1098 T Hampton University online

Filling out the 1098 T form can be a straightforward process with the right guidance. This guide is designed to help you complete the form accurately and efficiently, ensuring you understand each section and requirement.

Follow the steps to successfully complete your 1098 T form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

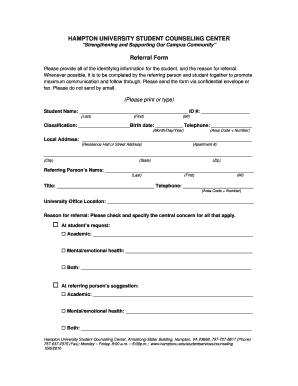

- Enter the student’s name in the designated field, ensuring you provide the last name, first name, and middle initial appropriately.

- Fill in the student’s identification number where indicated, which is essential for proper processing of the form.

- Select the student's classification and provide their birth date in the specified format (Month/Day/Year) for accurate identification.

- Include the student's current telephone number, formatted with the area code and number.

- Enter the local address for the student, providing details such as residence hall or street address, apartment number, city, state, and zip code.

- Provide the referring person’s name, title, and telephone number, ensuring you use the correct format for clarity.

- State the reason for the referral by checking the appropriate box(es) and supplying any necessary details for the specified concerns.

- Ensure that both the referrer and the student provide their signatures on the form along with the date, confirming the information is accurate.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your 1098 T form online today to ensure all information is submitted accurately and on time.

You should enter the information from your 1098 form on your federal tax return within the Education Credits section. On Form 1040 or 1040A, you will find designated areas for entering the amounts related to your education expenses. For clarity, if you need assistance, there are many tax preparation resources available, including tools on the US Legal Forms platform that can help you complete this process confidently and accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.