Loading

Get Alabama Dept Of Revenue Form Nr Af2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alabama Dept Of Revenue Form Nr Af2 online

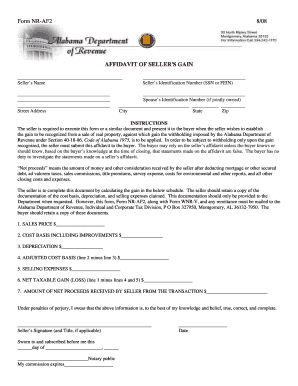

Filling out the Alabama Department of Revenue Form Nr Af2 online is essential for sellers wishing to establish the gain recognized from a sale of real property. This guide provides a step-by-step approach to complete the form accurately and efficiently.

Follow the steps to complete the Alabama Dept Of Revenue Form Nr Af2 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the seller’s name in the designated field. Ensure to include the full and accurate name of the seller.

- In the next field, input the seller’s street address, including the city, state, and zip code.

- Enter the seller’s identification number, which can be either the social security number (SSN) or the federal employer identification number (FEIN). If the property is jointly owned, provide the spouse’s identification number as well.

- Proceed to complete the sales price field, indicating the total amount for which the property is being sold.

- Fill in the cost basis, including any improvements made to the property. This figure is crucial for calculating any gains.

- Indicate the total amount of depreciation that has been claimed on the property.

- Calculate the adjusted cost basis by subtracting the depreciation from the total cost basis. Enter this number in the specified field.

- Detail any selling expenses incurred, including commissions and closing costs.

- Finally, calculate the net taxable gain or loss by subtracting the adjusted cost basis and selling expenses from the sales price. Enter this amount in the provided field.

- Document the amount of net proceeds received by the seller from the transaction, which represents the total funds received.

- Once all fields are completed, review the information for accuracy. The seller must sign and date the form, confirming that the information is true and complete.

- Save your changes, and proceed to download, print, or share the completed form as required.

Complete your Alabama Department of Revenue Form Nr Af2 online today!

To obtain an Alabama withholding tax number, start by visiting the Alabama Department of Revenue's website. There, you can access the necessary forms, including the Alabama Dept Of Revenue Form Nr Af2, which you will need to complete. Make sure to gather all relevant information about your business before applying. If you need guidance, their helpful resources can assist you through the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.