Loading

Get Ma Schedule C 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule C online

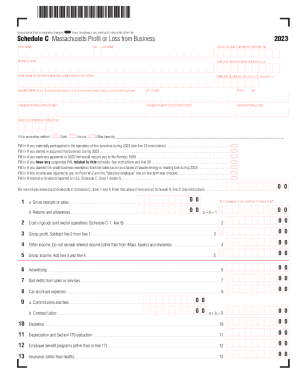

This guide provides essential steps for completing the MA Schedule C, the form used to report profits or losses from a business in Massachusetts. Whether you are new to online filing or need a refresher, this user-friendly approach will ensure that you fill out the form accurately and efficiently.

Follow the steps to successfully complete the MA Schedule C online.

- Click ‘Get Form’ button to access the MA Schedule C form and open it in your preferred online editor.

- Begin by filling in your first name, middle initial, last name, and the social security number of the proprietor in the designated fields at the top of the form.

- Enter your business name along with the employer identification number if applicable.

- Specify your main business or profession, detailing the product or service provided. Make sure to include the principal business code from the U.S. Schedule C.

- Provide your mailing address, including any apartment, suite, or postal box details. For foreign addresses, complete the additional fields for foreign province/state/county and postal code.

- Indicate the number of employees you have.

- Select your accounting method by filling in the appropriate oval: cash, accrual, or other, and specify if necessary.

- Complete the questions regarding your business operations in 2023, including material participation and any payments that require a Form 1099.

- Fill in the income details, starting with gross receipts or sales, and account for any returns and allowances.

- Calculate the cost of goods sold and/or operations, if applicable, and ensure to subtract this from gross receipts to find your gross profit.

- List all other income sources excluding interest income and dividends, and calculate your total gross income.

- Detail all business expenses in the respective sections, ensuring to include all allowable deductions.

- After filling in all necessary fields, review your entries for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form.

Complete your MA Schedule C online today for an accurate and efficient filing experience.

Mass. Schedule C is provided to report income and deductions from each business or profession operated as a sole proprietor- ship. A copy of U.S. Schedule C (or Schedule F for farm income) and U.S. Form 4562 (Depreciation and Amortization) must be filed with the Mass.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.