Loading

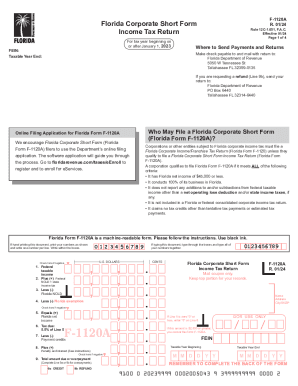

Get Irs Form F-1120 - Florida Corporate Tax Return - 2021. ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form F-1120 - Florida Corporate Tax Return - 2021 online

Filing the IRS Form F-1120, the Florida Corporate Tax Return for the tax year 2021, is essential for corporations doing business in Florida. This guide provides clear, step-by-step instructions to help users successfully navigate and complete the form online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your federal employer identification number (FEIN) and the taxable year end in the provided fields.

- Complete questions A through J on the form, answering each in accordance with the entity's status and activities.

- Line 1 requires you to enter your federal taxable income from the federal form. Ensure the amount is accurate.

- On Line 2, add your net operating loss deduction and state income taxes as specified. Make sure these figures come from your federal tax return.

- Proceed to Line 3 to enter any Florida net operating loss deduction you may have, understanding the limitations that apply.

- Line 4 is reserved for the Florida exemption. Enter the correct exemption based on your net income and proration if your taxable year is less than 12 months.

- Calculate your Florida net income by completing Line 5, which involves subtracting Lines 3 and 4 from the sum of Lines 1 and 2.

- Multiply the amount on Line 5 by the corporate tax rate for Line 6. If you determine the amount is zero or less, enter zero.

- For Line 7, input any payment credits from tentative tax paid or estimates made during the tax year.

- Include any penalties or interest due on Line 8, if applicable, and calculate your total amount due or overpayment on Line 9.

- Decide how to handle any overpayment—either as a credit toward next year's tax or for refund—and check the appropriate box.

- Finally, review all entries for accuracy, then save your changes, download the form, and print as needed before submitting.

Complete your IRS Form F-1120 online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Corporations must file Florida Form F-1120 each year, even if no tax is due. The due date is based on the corporation's tax year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.