Loading

Get Pa Local Tax Form 1605 - Bc3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Local Tax Form 1605 - Bc3 online

Filling out the PA Local Tax Form 1605 - Bc3 online can simplify the process of reporting local earned income taxes. This guide offers step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the PA Local Tax Form 1605 - Bc3 online.

- Click the ‘Get Form’ button to access the PA Local Tax Form 1605 - Bc3 and open it in your online editor.

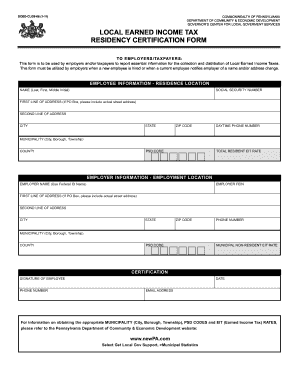

- Enter the employee information in the designated fields. You will need to provide the full name, social security number, residence address (including street address), city, state, zip code, daytime phone number, municipality, county, and PSD code. Make sure all details are accurate, as this information is crucial for tax collection.

- Fill in the employer information section. Provide the employer's name as per the federal ID, employer FEIN, address, city, state, zip code, phone number, municipality, county, and PSD code. Ensure this information matches official records.

- Indicate the total resident EIT rate applicable to the employee and the municipal non-resident EIT rate, if applicable. Double-check these rates with local tax authority resources as needed.

- Complete the certification section by having the employee sign the form. They should also provide their phone number, date of completion, and email address, ensuring all contact details are correct.

- Once all sections are filled out completely, you can save changes. Depending on your needs, you can download the form for your records, print it, or share it with relevant parties.

Start completing the PA Local Tax Form 1605 - Bc3 online today for a streamlined tax filing experience.

If the tax is withheld in another PA community where I work, do I also pay the PA District in which I live? No. Generally the tax withheld by your employer will be remitted to your resident jurisdiction. However, you are still required to file an annual tax return with your resident taxing jurisdiction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.