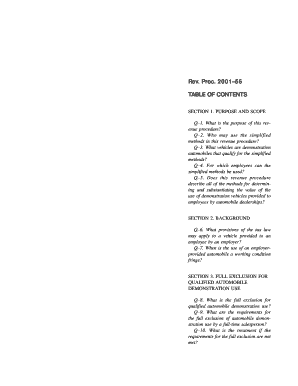

Get 45d(c)(1)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 45D(c)(1) online

Filling out the 45D(c)(1) form online can seem daunting, especially for those who may not have significant experience with legal documents. This guide aims to provide a clear and supportive framework to help users understand each component of the form and successfully complete it online.

Follow the steps to efficiently complete the 45D(c)(1) form online.

- Click the ‘Get Form’ button to obtain the form and access it in your browser.

- Begin with the personal information section. Enter your full name, address, and contact details. Ensure all entered information is accurate and up to date.

- Move to the employment details section. Input your employer’s information including name, address, and your position within the company.

- In the financial information section, provide your income details. Make sure to include all relevant data such as salary, bonuses, and any other earnings.

- Complete the specific declarations section. Read through the statements and check the appropriate boxes indicating your agreement or acknowledgment.

- Review all entered information for accuracy. Verify that all required fields have been satisfactorily filled out without any omissions.

- Once you are satisfied with the form, you can save your changes, download the document for your records, or print it for submission.

Start filling out the 45D(c)(1) form online today to ensure your submission is timely and accurate.

A community development entity (CDE) is a domestic corporation or partnership that focuses on serving low-income communities. CDEs aim to provide capital and financial services to boost economic opportunities in these areas. Engaging with a CDE can be an effective way to access tax credits like those found under section 45D(c)(1). By partnering with the right CDE, you can make a significant impact in your community.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.