- US Legal Forms

- Form Library

- More Forms

- More Multi-State Forms

- NY TC309 2022

Get NY TC309 2022-2024

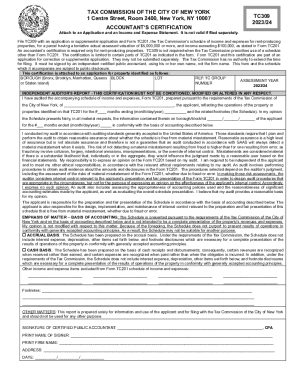

Not valid if filed separately. File TC309 with an application or supplemental application and Form TC201, the Tax Commission s schedule of income and expenses for rent-producing properties, for a parcel having a tentative actual assessed valuation of $5,000,000 or more, and income exceeding $100,000, as stated in Form TC201. An accountant s certification is required only for rent-producing properties. TC309 is not required when the Tax Commission prescribes use of a schedule other than Form.

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Disbursements FAQ

-

Auditors examine, analyze, and interpret accounting records to prepare financial statements, give advice, or audit and evaluate statements prepared by others. or advise on systems of recording costs or other financial and budgetary data.

-

The Tax Commission is the City of New York's forum for independent administrative review of annual real property tax assessments set by the NYC Department of Finance. The Tax Commission is a separate agency independent of the Department of Finance.

-

Welcome to TC309 The Certification consists of an independent auditor's report which the auditor uses to express an opinion on the schedule of income and expenses reported on Form TC201.

-

Real estate tax certiorari is the legal process by which a property owner can challenge the real estate tax assessment on a given property to reduce its real estate taxes.

-

The Tax Commission cannot raise assessments and filing a challenge is free unless a property's assessed value exceeds $2 million; for higher-value properties, the fee is $175. Lawyers who specialize in disputing assessments, known as tax certiorari attorneys, generally work for a contingency fee.

Accrual Related content

-

Accountant's certification. Attach to TC201

File TC309 with an application or supplemental application and Form TC201, the Tax...

Learn more -

Other Forms - Tax Commission

... TC309 - Accountant's Certification. Attach to TC201 · TC584 - Freedom of Information...

Learn more -

Pulbic Packet - Office of the Professions

Feb 1, 2022 — Mr. Maffia inquired regarding the New York City Tax Department's...

Learn more -

Appendix L: Traffic Control Plan

(TYP). TAPER. TRAFFIC. TWO-WAY. ONE LANE. DET-TC309. F. E. D. C. B. A. 1. 2. 3. 4. 5. F...

Learn more -

Jan 2022 CPA Board Meeting Minutes.docx

Jan 26, 2022 — the NYC Form TC-309 for certioraris that is not in accordance with...

Learn more -

IRS Processing Codes and Information 2013

... NY. 02. Bala Cynwyd, PA. 03. Atlanta, GA. 04. Chicago, IL. 05. Dallas, TX. 06. Kansas...

Learn more -

EX-10.9

New York, NY 10018. Office: 212-967-4590. Fax: Rebecca Langendoen, Property ... TC-309...

Learn more -

TC Memo. 2021-65

May 27, 2021 — Commissioner, 113 T.C. 309, 316-317 (1999) (declining to determine...

Learn more -

FAA Registry - Aircraft - Canceled Aircraft...

TC309, 8780404, SWEARINGEN SA226TC 1979, 08/13 ... 3377509, FAIRCHILD SA227-AC None...

Learn more -

Accountant's certification. Attach to TC201

File TC309 with an application or supplemental application and Form TC201, the Tax...

Learn more -

Forms - Tax Commission

... TC309, TC584, TC707, TC708, TCAT, TCPT,TCTEMP. Personal Exemptions: TC600PE ... Also...

Learn more -

Pulbic Packet - Office of the Professions

Feb 1, 2022 — Mr. Maffia inquired regarding the New York City Tax Department's...

Learn more -

Property tax calendar - Tax.NY.gov

Jan 11, 2023 — Important assessment roll dates for property owners · 1. Taxable Status...

Learn more -

Jan 2022 CPA Board Meeting Minutes.docx

Jan 26, 2022 — Maffia inquired regarding the New York City Tax Department's requirement...

Learn more -

EX-10.9

Tenant shall give Landlord prompt notice of any defective condition in any Building...

Learn more -

8.20.7 Closing Procedures | Internal Revenue...

In docketed cases, verify that the decision document, settlement computation and Form...

Learn more -

APPENDIX

May 17, 2023 — Form 706, with the Internal Revenue Service (IRS). On October 23, 2001...

Learn more -

Outdoor Tables and Chairs

Landscape Forms Inc. TC309, Outdoor Tables and Chairs, $ 3,623, 4.71%, 0%, 4.71%, $...

Learn more -

Accountant's certification. Attach to TC201

File TC309 with an application or supplemental application and Form TC201, the Tax...

Learn more -

Forms - Tax Commission

2023/24 Real Property Tax Assessment Application Forms and Instructions. NOTE: THE TAX...

Learn more -

Pulbic Packet - Office of the Professions

Feb 1, 2022 — The Chair of the Nominations Committee will present to the full Board for...

Learn more -

Jan 2022 CPA Board Meeting Minutes.docx

Jan 26, 2022 — Spring 2022. Legislative ... Maffia inquired regarding the New York City...

Learn more -

Property tax calendar - Tax.NY.gov

Jan 11, 2023 — Your 2022 assessment was based on the value of your vacant lot on July 1...

Learn more -

EX-10.9

... 2022 Tax Year.” (6) Section 3.2(B)(III) of this Lease shall be deleted in its...

Learn more -

APPENDIX

May 17, 2023 — (July 2022). Under federal law, in order to make an effective disclaimer...

Learn more -

APPENDIX

2022). A taxpayer receives the interest in the property “immediately” on the date of...

Learn more -

UNITED STATES TAX COURT

Jun 23, 2022 — Retired Tax Court Judge Robert P. Ruwe passed away on. February 12, 2022...

Learn more -

Global Governance Summit 2022: ESG - Driving...

Aug 25, 2022 — Investigate the latest developments in governance from global thought...

Learn more -

2020-2021 Catalog

form, available online and in the Office of Registration and Records, is ... Graduation...

Learn more -

Copycat Compliance and the Ironies of "Best...

by WR Heaston · 2022 · Cited by 7 — 27, 2022) (listing an array of international...

Learn more -

This document is discoverable and free to...

by F Rampone · 2023 · Cited by 1 — This paper aims to demystify a lot of...

Learn more -

RESEARCH

The present Zofnass Program research “Assessment of Projects for (a) mitigation and...

Learn more -

Engineering for Sustainable Development United...

... 2022, all of which will require engineering for sustainable development. © Mr...

Learn more -

ASEAN JOURNAL OF MANAGEMENT & INNOVATION

by P Phaewprayoon · 2020 — form it and the values governing their actions, Ogliastri...

Learn more -

(PDF) Global Challenges in the Standardization of...

In this paper, we examine the challenges of developing international standards for...

Learn more -

Global Governance Summit 2022: ESG - Driving...

Aug 25, 2022 — Investigate the latest developments in governance from global thought...

Learn more -

Copycat Compliance and the Ironies of "Best...

by WR Heaston · 2022 · Cited by 7 — 27, 2022) (listing an array of international...

Learn more -

Catalog 2021-2022

Aug 27, 2021 — Department of Education website, www. studentloans.gov, using their ... A...

Learn more -

RESEARCH

... 2022). Working Group I, Working. Group II, and Working Group III reports were approved...

Learn more -

This document is discoverable and free to...

by F Rampone · 2023 · Cited by 1 — from 2018 to 2022. Many of the ideas and concepts...

Learn more -

(PDF) Global Challenges in the Standardization of...

In this paper, we examine the challenges of developing international standards for...

Learn more -

Engineering for Sustainable Development United...

... 2022, all of which will require engineering for sustainable development. © Mr ... New...

Learn more -

ASEAN JOURNAL OF MANAGEMENT & INNOVATION

by P Phaewprayoon · 2020 — (2013-2022). Asian Development Bank. (2014). Regional...

Learn more -

Accountant's certification. Attach to TC201

File TC309 with an application or supplemental application and Form TC201, the Tax...

Learn more -

Forms - Tax Commission

2023/24 Real Property Tax Assessment Application Forms and Instructions. NOTE: THE TAX...

Learn more -

Pulbic Packet - Office of the Professions

Feb 1, 2022 — the NYC Form TC-309 for certioraris that is not in accordance with...

Learn more -

Jan 2022 CPA Board Meeting Minutes.docx

Jan 26, 2022 — Maffia inquired regarding the New York City Tax Department's requirement...

Learn more -

Property tax calendar - Tax.NY.gov

Jan 11, 2023 — Your 2022 assessment was based on the value of your vacant lot on July 1...

Learn more -

EX-10.9

Tenant shall give Landlord prompt notice of any defective condition in any Building...

Learn more -

APPENDIX

May 17, 2023 — (July 2022). Under federal law, in order to make an effective disclaimer...

Learn more -

Factoring Criteria for Firearms With Attached...

Jan 31, 2023 — FATD advised that the “Retractable Pistol Stabilizing Brace” would...

Learn more -

APPENDIX

2022). A taxpayer receives the interest in the property ... section 2204 nor any...

Learn more -

Intercircuit Tribunal or a Court of Tax Appeals

by JP Galvin Jr · 1984 · Cited by 4 — 442 (1983); Jenkins, A Talk with Justice...

Learn more -

Tax research techniques

by RL Gardner · 1993 · Cited by 8 — Published and copyrighted by Research Institute of...

Learn more -

Alimony and the Income Tax

by JH Wahl Jr · 1949 · Cited by 3 — Such a suit had been instituted by the wife in New...

Learn more -

ANALISIS PLASTIS* TC309 - Direktori File UPI

Structures, John Willey & Sons, New York ; SK Duggal, 1993, Design of Steel structures...

Learn more -

Reinterpretation of Internal Revenue Code Section...

by SB Connolly · 1997 · Cited by 3 — As between life's two certainties, death and...

Learn more -

Tax Free Earning for Retirement

by ID ISKO · Cited by 2 — Member of the New York Bar. 'H.R. 10, H.R. 11, 83d Cong' 1st...

Learn more -

2020-2021 Catalog

A continuation of TC-309 where students are expected to design model, simulate ... BS...

Learn more -

Verification and Validation Benchmarks

by WL Oberkampf · 2007 · Cited by 382 — AMSRL-WM-TC 309 120A. Aberdeen Proving Gd, MD...

Learn more -

FACILITIES MASTER PLAN

Mar 22, 2017 — • Economic Development Strategic Plan Prepared for Saratoga County, NY...

Learn more -

Tax research techniques

by RL Gardner · 1993 · Cited by 8 — would be 83 T.C. 309. Bound volumes of the Tax...

Learn more -

Tax Free Earning for Retirement

by ID ISKO · Cited by 2 — Every individual, not covered by a 'tax deferred pension...

Learn more -

Reinterpretation of Internal Revenue Code Section...

by SB Connolly · 1997 · Cited by 3 — As between life's two certainties, death and...

Learn more -

Recent Developments in Federal Income Taxation

by IB Shepard · 2009 — The form letter was the wrong form letter, but the Gregorys...

Learn more -

Alimony and the Income Tax

by JH Wahl Jr · 1949 · Cited by 3 — reversal of supposed form, the relationship...

Learn more -

Recent Developments in Federal Income Taxation

by MJ McMahon Jr · 2023 · Cited by 4 — Commissioner, 85 T.C. 309, 322-323 (1985), and...

Learn more -

Bad Debt Deductions for Capital Lost Through...

by FDLF a Non — rather than by its form. See, generally, OSBORNE § 20; WALSH § 91; 1...

Learn more -

Law Enforcement Manual (LEM) III, Form #09.042

This paper uses micro data from individual tax returns audited during the 1971 cycle of...

Learn more -

2020-2021 Catalog

forms and controls, state management, validation and error handling, SQL database ... A...

Learn more -

Tax News - Bills / Cases / IRS - Gift Planning...

Ringling incorrectly states that Form 4340 states the unpaid liabilities as of May 25...

Learn more

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to NY TC309

- propertys

- staten

- misstatements

- misrepresentations

- omissions

- GAAS

- Disbursements

- accrual

- appropriateness

- disclosures

- reasonableness

- purport

- valuation

- signer

- prescribes

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.