Loading

Get About Form 943-x, Adjusted Employer's Annual Federal ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

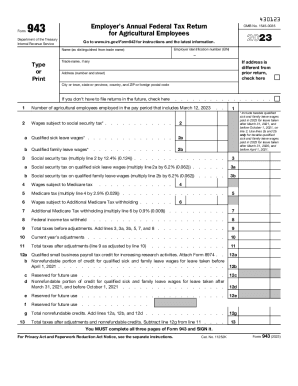

How to fill out the About Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees online

Filling out the About Form 943-X is essential for employers in the agricultural sector who need to submit their adjusted federal tax return. This guide will provide clear and straightforward instructions on how to complete the form online, ensuring a smooth submission process.

Follow the steps to complete the About Form 943-X effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN) in the designated field at the top of the form. Ensure the EIN is correct, as it is vital for processing your return accurately.

- Provide your name as it differs from your trade name in the next field. Make sure to follow the form's instructions for formatting your name.

- If you have a trade name, include it in the appropriate section. If your address has changed since your last return, indicate this by checking the designated box.

- Fill in your complete business address, including the street, city or town, state or province, country, and ZIP or foreign postal code.

- Specify the number of agricultural employees employed in the pay period that includes March 12, 2023, in the designated area.

- Enter total wages subject to social security tax, qualified sick leave wages, and qualified family leave wages in the corresponding fields on the form, following the instructions carefully.

- Calculated fields such as social security tax and Medicare tax will need to be completed by multiplying the appropriate line amounts by the designated percentages provided in the form.

- Complete any current year’s adjustments as needed. Ensure you also calculate total taxes before and after the adjustments thoroughly.

- Fill in any applicable credits and ensure that you finish all three pages of the form by signing it at the end. Remember to include any necessary attachments.

- Once completed, save changes to your document. You can download the form, print it, or share it as necessary for submission.

Complete your About Form 943-X online today to ensure compliance and accuracy in your tax filings.

Related links form

Form 943 is required for agricultural businesses with farmworkers. You'll file this form with the IRS annually. Some businesses may be required to file both a 943 and a 941 or a 944. This form is available to both Automate taxes and forms On or Off options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.