Loading

Get 2008 Form 1045

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

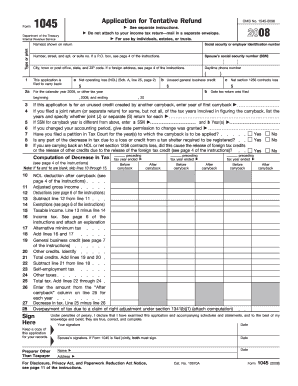

How to fill out the 2008 Form 1045 online

Filling out the 2008 Form 1045 online allows users to efficiently apply for a tentative refund based on a net operating loss or unused general business credits. This guide provides clear, step-by-step instructions to help users navigate the process with ease.

Follow the steps to successfully complete your Form 1045 online.

- To begin, click the ‘Get Form’ button to obtain the form and open it in your browser's editor.

- Enter the name(s) shown on your tax return along with your Social Security or Employer Identification Number in the specified fields.

- Provide your address, including the street, city, state, and ZIP code. If your address is foreign, make sure to refer to the appropriate guidelines as indicated in the instructions.

- Enter your daytime phone number to facilitate any communication regarding your application.

- In the application sections, mark whether you are carrying back a net operating loss, unused general business credit, or a net section 1256 contracts loss, and enter relevant financial amounts where required.

- Fill out the computation tables in the form carefully, ensuring that you provide accurate figures for tax before and after the carryback.

- Review the section that asks if you have filed a petition in Tax Court for the years the carryback will apply, selecting 'Yes' or 'No' as appropriate.

- Make sure to complete the necessary schedule sections, including calculating your NOL and any applicable carryovers.

- Once all sections are filled out and verified, use the functionality in your editor to save changes, download a copy of the form, print it, or share it as needed.

Start completing your Form 1045 online today to ensure a smooth process for your tentative refund application.

The purpose of the 2008 Form 1045 is to facilitate a quick refund for taxpayers who experience a net operating loss and choose to apply this loss to a prior year's income. This form simplifies the process of receiving your refund more swiftly compared to awaiting the standard tax filing cycle. Utilizing US Legal Forms can help ensure you complete this form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.