Loading

Get Ky Reconciliation Of Occupational License Fee Withheld - Whitley County 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Reconciliation Of Occupational License Fee Withheld - Whitley County online

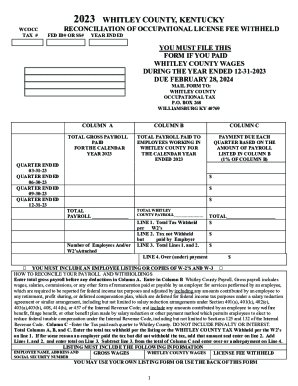

Completing the KY Reconciliation Of Occupational License Fee Withheld form for Whitley County is essential for employers who have paid wages to employees within the county. This guide will help you navigate the online filling process with clarity and confidence.

Follow the steps to accurately complete the reconciliation form.

- To begin, click the ‘Get Form’ button to access the form and open it in your preferred online editing tool.

- Fill in your tax identification number in the designated area at the top of the form. Ensure that this number matches your IRS documentation for accuracy.

- Identify the tax year for which you are filing the reconciliation. In this case, indicate '2023' for the year ended December 31, 2023.

- Enter the total gross payroll under Column A. This figure should reflect all compensation paid to employees for the calendar year 2023, before any deductions.

- In Column B, record the total payroll that was actually paid to employees working in Whitley County for the calendar year. This number should align with the wages reported for local tax purposes.

- Complete Column C by calculating the payment due each quarter, which is 1% of the amount listed in Column B.

- Sum the totals in Columns A, B, and C at the bottom of their respective sections to ensure accurate totals.

- List the total tax withheld per W-2s on Line 1. If you have paid tax that was not withheld, include that amount on Line 2.

- Add the totals from Line 1 and Line 2, and enter the total on Line 3. Then, subtract Line 3 from the total of Column C to determine any over or underpayment, which you will enter on Line 4.

- Attach a listing of employees or copies of W-2s as required. This listing should include each employee's name, address, Whitley County wages, gross wages, license fee withheld, and social security number.

- Once all fields are completed and verified, save your changes, download the completed form, and print or share it as needed for submission.

Take the next step and complete your reconciliation document online today.

The occupational license tax shall be measured by 2% of (a) All wages and compensation paid or payable for work done or services performed or rendered in the county by every employee. Grant County Occupational Tax Ordinance ky.gov https://grantcounty.ky.gov › uploads › 2015/11 › Grant-... ky.gov https://grantcounty.ky.gov › uploads › 2015/11 › Grant-...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.