Loading

Get June 2023 - Department Of Revenue (ky.gov) - Kentucky.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

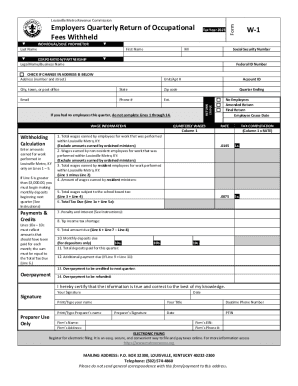

How to fill out the June 2023 - Department Of Revenue (ky.gov) - Kentucky.gov online

Filling out the June 2023 form from the Department of Revenue can be straightforward if you follow the right steps. This guide provides clear, detailed instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your last name, first name, and middle initial in the designated fields. If you are an individual or sole proprietor, complete these sections clearly.

- For corporations or partnerships, provide the legal name/business name along with the federal ID number in the appropriate fields.

- Indicate any address changes by checking the box provided before entering your address. Include street number and name, unit/apartment number, city, state, and zip code.

- Fill in your email address and phone number, including any extension needed for contact.

- Select the quarter ending you are reporting for and indicate your status by checking any applicable boxes, such as 'No Employees,' 'Amended Return,' or 'Final Return.'

- For wage information, complete Lines 1 through 5 with the total wages earned by employees and any adjustments as specified, ensuring you exclude amounts earned by ordained ministers.

- Complete the tax computation section accurately, applying the given rates for specific lines. Compute any penalties or additional amounts due as shown.

- Review your entries to confirm all information is accurate before moving to the signature section.

- Sign and date the form, and print/type your name for identification as the preparer. If someone else prepared it, provide their details in the preparer use section.

- Finally, save your changes, download the completed form, and print or share it as needed for your records.

Complete your document online with confidence and ensure accurate filing today.

(September 21, 2022) Each year, the Kentucky Department of Revenue (DOR) calculates the individual standard deduction in ance with KRS 141.081. After adjusting for inflation, the standard deduction for 2023 is $2,980, an increase of $210.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.