Loading

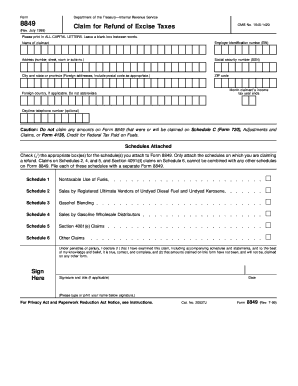

Get Omb No 1545 1420 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Omb No 1545 1420 Form online

Filling out the Omb No 1545 1420 Form online can be a straightforward process if you know the steps involved. This guide aims to provide a clear and comprehensive walkthrough to assist you in accurately completing the form for claiming refunds of excise taxes.

Follow the steps to fill out the Omb No 1545 1420 Form online.

- Click the ‘Get Form’ button to obtain the Omb No 1545 1420 Form and open it in your browser's PDF viewer.

- Begin filling out the form by entering your name in the 'Name of claimant' field. Ensure that you print in all capital letters and leave a blank box between words.

- Input your Employer Identification Number (EIN) or Social Security Number (SSN) in the respective fields. Double-check for accuracy to avoid delays in processing.

- Fill in your address information, including number, street, room or suite number. If applicable, include your foreign address while ensuring to follow the proper format.

- Enter the city and state or province, along with the ZIP code. If you have a P.O. box, enter that instead of your street address.

- Indicate the month your income tax year ends by entering the corresponding numerical value (e.g., 12 for December).

- Provide your daytime telephone number, if you wish; this step is optional but can facilitate communication.

- Check the appropriate boxes for the schedules you are attaching. Make sure you only attach schedules relevant to your claims.

- Review the caution statement regarding the amounts you can claim on the form. Do not include claims that will be made on other forms.

- Sign and date the form in the designated areas. Unsigned forms will not be processed.

- After completing all sections, save the changes. You can then download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth filing process.

Filling out your tax form starts with gathering all your income information and documents. Next, you should carefully complete each section, including any relevant deductions or exclusions. If you qualify for the foreign earned income exclusion, use the Omb No 1545 1420 Form to claim that benefit. Utilizing resources from uslegalforms can help streamline this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.