Loading

Get Irs8938 Continuation Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs8938 Continuation Sheet online

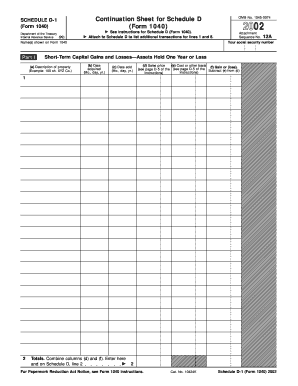

The Irs8938 Continuation Sheet is an essential document used to report additional transactions for capital gains and losses. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently online.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access and open the Irs8938 Continuation Sheet in your preferred document editor.

- Begin by entering the name(s) as shown on Form 1040 and provide your social security number in the designated fields. This information is vital for accurately linking your transactions to your tax return.

- In Part I, start detailing your short-term capital gains and losses. For each asset, fill out the description in column (a), the date acquired in column (b), the date sold in column (c), the sales price in column (d), and the cost or other basis in column (e).

- Calculate the gain or loss by subtracting the cost or other basis in column (e) from the sales price in column (d), and enter the result in column (f). This step is crucial for determining your taxable income.

- Proceed to Part II for long-term capital gains and losses. Again, fill out the description in column (a), the date acquired in column (b), the date sold in column (c), the sales price in column (d), and the cost or other basis in column (e).

- Calculate the gain or loss and enter this figure in column (f). If applicable, complete column (g) for any 28% rate gains or losses, ensuring you follow the specific instructions provided.

- After completing all relevant sections, combine your totals from the short-term and long-term sections and enter them as required on your Schedule D.

- Finally, review your entries for accuracy, then save your changes, and download or print the completed form for your records or to attach to your tax return.

Start completing your Irs8938 Continuation Sheet online today for a smoother tax filing experience.

The filing deadline for the Irs8938 Continuation Sheet generally coincides with your federal tax return due date, typically April 15. If you file for an extension, this deadline extends to October 15. Staying aware of these deadlines helps ensure you meet your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.