Loading

Get Tax Brief: Form 990, What You Need To Know About ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Brief: Form 990, What You Need To Know About ... online

Filing the Tax Brief: Form 990 is an important step for organizations to fulfill their reporting obligations. This guide will provide you with a comprehensive approach to completing Form 990 online, ensuring clarity and accuracy throughout the process.

Follow the steps to accurately complete Form 990 online.

- Click ‘Get Form’ button to obtain the form and open it in the editing platform.

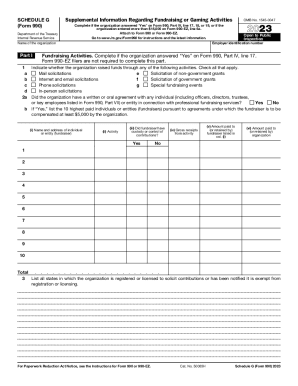

- Begin with Part I: Fundraising Activities. Indicate whether your organization has raised funds through various activities by checking all applicable options (mail solicitations, internet solicitations, etc.). For each activity, provide details if asked.

- Proceed to the next question regarding agreements with individuals or entities for fundraising services. Answer ‘Yes’ or ‘No’ and, if applicable, list the ten highest paid fundraisers associated with the organization.

- In Part II: Direct Expenses, report gross receipts and deduct contributions to calculate gross income. Outline any direct expenses related to fundraising.

- For fundraising events, list events with gross receipts exceeding $5,000 and provide summary information on revenue and expenses.

- If applicable, complete the gaming section in Part III. Provide information on gaming activities conducted by the organization, including revenue, expenses, and whether the organization is licensed to conduct these activities.

- In Part IV: Supplemental Information, provide any required explanations or additional information that pertains to the form.

- Once all sections are completed, save any changes made to the form, and proceed to download, print, or share it as necessary.

Complete your documents online to ensure compliance and accurate reporting.

Form 990 specifically asks the filing organization to report if certain documents are made available to the public, such as governing documents (like the bylaws), conflict of interest policy, and financial statements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.