Loading

Get Ny Dtf It-2664 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-2664 online

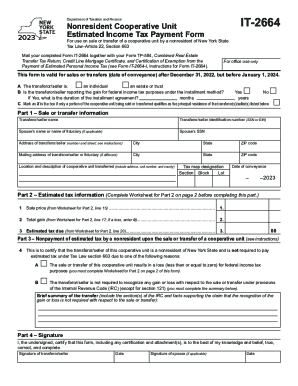

Filling out the NY DTF IT-2664 form is essential for nonresidents of New York State involved in the sale or transfer of a cooperative unit. This guide provides a detailed, step-by-step approach to ensure accurate completion of the form online.

Follow the steps to complete the NY DTF IT-2664 accurately.

- Click ‘Get Form’ button to access the NY DTF IT-2664. This will allow you to open the document for editing.

- Begin by completing Part 1, where you need to enter the transferor or seller's name, identification number (SSN or EIN), and, if applicable, the spouse or fiduciary's details along with their identification number. Include the mailing address and other relevant information for the cooperative unit.

- For Part 2, refer to the worksheet on page 2 to determine the sale price, total gain, and estimated tax due. Enter these figures in the corresponding fields.

- Moving to Part 3, certify if the transferor/seller is a nonresident and indicate the reason for nonpayment of estimated tax, if applicable. Provide a brief summary if necessary.

- In Part 4, both the transferor/seller and spouse (if applicable) need to sign and date the form, certifying that the information provided is accurate.

- Finally, review the completed form for accuracy. Once satisfied, save your changes, download the form, or print it for submission.

Complete your NY DTF IT-2664 form online and ensure all required documentation is submitted accurately.

New York's income tax rates range from 4% to 10.9%. The top tax rate is one of the highest in the country, though only taxpayers whose taxable income exceeds $25,000,000 pay that rate. Taxpayers in New York City have to pay local income taxes in addition to state taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.