Loading

Get Form 8860 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8860 Instructions online

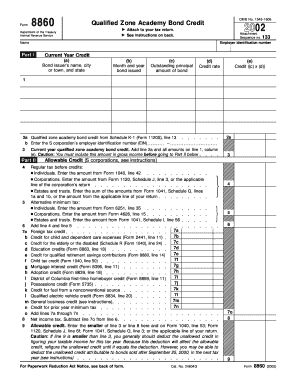

Completing the Form 8860 Instructions online can be straightforward with the right guidance. This form enables eligible individuals to claim the Qualified Zone Academy Bond Credit, providing a financial benefit for supporting public education.

Follow the steps to effectively fill out the form.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In Part I, provide the bond issuer’s name, city or town, and state in column (a). Next, specify the month and year the bond was issued in column (b).

- Enter the outstanding principal amount of the bond in column (c). This should reflect the face value minus any principal payments you have received.

- Input the applicable credit rate in column (d). Depending on when the bond was issued, refer to IRS guidelines for the correct rate.

- Calculate the credit by multiplying the amount in column (c) by the rate in column (d), and place the result in column (e).

- Complete line 2a if you received credits as an S corporation shareholder, indicating the corresponding employer identification number (EIN).

- For line 3, combine line 2a and all entries in column (e) from line 1. Ensure you include this amount in your gross income before proceeding to Part II.

- In Part II, enter your regular tax before credits based on your filing status—individuals, corporations, or estates and trusts—on line 4.

- Reference the alternative minimum tax for your category and input this value on line 5.

- Add the amounts from lines 4 and 5 and record the total.

- List any applicable credit amounts from lines 7a through 7n on line 7o and compute the net income tax by subtracting line 7o from line 6.

- On line 9, enter the smaller amount between line 3 and line 8. This represents your allowable credit. Transfer this result to your tax return form where appropriate.

- Finally, you can save your changes, download, print, or share the completed form.

Start completing your Form 8860 online for a smoother filing experience.

Form 8960 refers to the Net Investment Income Tax, which is a tax imposed on certain investment income for taxpayers with high income. It applies to various types of income such as rental income, interest, and capital gains. Understanding the implications of this form is crucial for effective tax planning and compliance. To navigate this and learn how it affects you, check our detailed Form 8860 instructions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.