Loading

Get 2002 Irs F8606 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2002 IRS F8606 form online

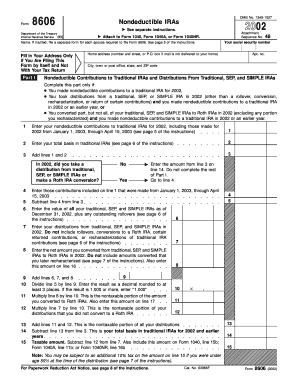

The 2002 IRS F8606 form is essential for reporting nondeductible contributions to traditional IRAs and conversions to Roth IRAs. This guide provides clear, step-by-step instructions for smoothly completing and submitting this form online.

Follow the steps to complete the 2002 IRS F8606 form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by entering your personal details. This includes your name and social security number. If you are married and both you and your partner need to file, ensure each of you uses a separate form.

- Fill in your home address only if you are submitting the form separately and not alongside your main tax return.

- In Part I, report any nondeductible contributions you made to traditional IRAs for the 2002 tax year. Ensure to include contributions made from January 1, 2003, to April 15, 2003, if applicable.

- Record your total basis in traditional IRAs on line 2. This figure reflects the total of your nondeductible contributions from previous years.

- Add the amounts from lines 1 and 2 on line 3. This will give you your total contributions for the period.

- Indicate whether you took any distributions from your traditional, SEP, or SIMPLE IRAs in 2002 by selecting ‘Yes’ or ‘No’. If 'Yes', proceed to complete the remainder of Part I.

- If you took distributions, continue entering any contributions made between January 1, 2003, through April 15, 2003, from line 4.

- After subtracting line 4 from line 3, enter the value of all your IRAs as of December 31, 2002, on line 6.

- Continue filling out the lines regarding distributions taken, converting to Roth IRAs, and ensuring all calculations are accurate based on the provided instructions.

- Once you complete all applicable sections, review your entries for accuracy. Then, save your changes appropriately.

- Finally, you can download, print, and share your completed form as necessary, ensuring to attach it to your Form 1040, Form 1040A, or Form 1040NR.

Complete your documents online and ensure your tax filing is accurate and up to date.

Related links form

To download forms from the IRS, go to their official website and navigate to the Forms and Publications section. You can easily search for specific forms, such as the 2002 IRS F8606 Form. Once you find your desired form, click the download button to get the latest version for your tax needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.