Loading

Get Irs 8865 - Schedule K-1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8865 - Schedule K-1 online

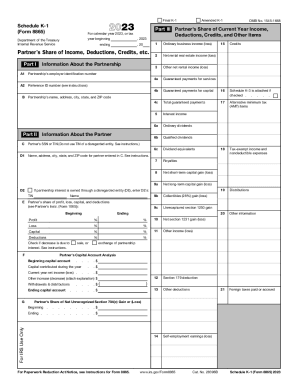

Filling out the IRS 8865 - Schedule K-1 can be a crucial step for partners in reporting income, deductions, and credits. This guide offers a clear, step-by-step approach to assist users in accurately completing this form online.

Follow the steps to successfully complete your IRS 8865 - Schedule K-1.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review 'Part I' which covers your share of income, deductions, and credits. Begin by entering your ordinary business income (loss) in box 1. Continue filling out sections for rental income, guaranteed payments, and various types of income such as interest and dividends in the corresponding boxes.

- Proceed to complete the partnership’s name and address in the designated section. Ensure that all details are accurate and match your partnership records to avoid discrepancies.

- Fill in your information in the 'Information About the Partner' section. This includes your social security number or taxpayer identification number, along with your name and address as specified.

- Document your partner’s share of profit, loss, capital, and deductions by indicating the percentages in the respective fields for both the beginning and ending of the year. Remember to check the box if there is a decrease due to the sale or exchange of partnership interest.

- Complete the 'Partner’s Capital Account Analysis' section, detailing your beginning capital account, capital contributed during the year, current year net income or loss, and withdrawals or distributions to arrive at your ending capital account.

- In the final section, provide any additional information such as net unrecognized section 704(c) gain or loss if applicable. Make sure to carefully follow any instructions provided to complete this section accurately.

- After reviewing all entries for accuracy, save your changes. You can then download, print, or share the form as needed.

Start filling out your documents online to ensure timely and accurate submission.

Form 8865, or the Return of US Persons With Respect to Certain Foreign Partnerships, is a tax form used by individuals and entities to report ownership of, transactions with, and certain other activities related to controlled foreign partnerships.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.