Loading

Get Irs 945 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 945 online

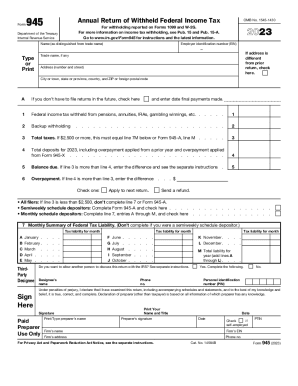

Filling out the IRS 945 form can seem challenging, but this guide will walk you through the process with ease. The IRS 945 is used for reporting withheld federal income tax from certain payments, and completing it accurately is essential for compliance.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the designated field as it appears on your tax records, distinguish it from any trade name you may use.

- Input your Employer Identification Number (EIN) in the specified box; if you do not have an EIN, follow the instructions provided to apply for one online before proceeding.

- If your address has changed since your last return, check the box indicating this change. Fill in your complete address, including the street number, city, state or province, and ZIP or foreign postal code.

- Indicate whether you will need to file this form in the future by checking the appropriate box.

- For Line 1, report the total federal income tax withheld from pensions, annuities, IRAs, gambling winnings, etc.

- On Line 2, indicate the amount of backup withholding reported.

- For Line 3, sum and enter your total taxes. If this amount is $2,500 or more, ensure it aligns with line 7M or Form 945-A, line M.

- Input total deposits for 2023 on Line 4, including any overpayments applied from the prior year or Form 945-X.

- Calculate the balance due on Line 5 if line 3 exceeds line 4, and seek further instructions if applicable.

- If line 4 exceeds line 3, report the overpayment on Line 6.

- Make selections regarding the handling of overpayments by checking the relevant options.

- Monthly summary details should be completed on Line 7 if you are a monthly schedule depositor, including tax liabilities for each month.

- Designate a third-party designee if desired, providing their name and phone number.

- After confirming all details are accurate, sign and date the form. If a paid preparer is assisting, they should complete their section.

- Once you have completed all sections of the form, save your changes. You can then download, print, or share the form as necessary.

Complete your IRS 945 form online today to ensure compliance and avoid any penalties.

You can e-file any of the following employment tax forms: 940, 941, 943, 944 and 945. Benefits to e-filing: It saves you time. It is secure and accurate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.