Loading

Get 2003 Form 1116

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2003 Form 1116 online

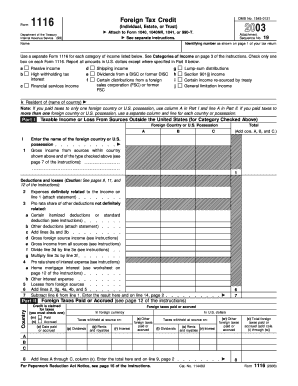

The 2003 Form 1116 is essential for individuals, estates, and trusts seeking to claim the foreign tax credit. This guide provides clear, step-by-step instructions on completing the form online, ensuring clarity and support for users with various levels of experience.

Follow the steps to fill out the 2003 Form 1116 online

- Press the ‘Get Form’ button to access the form and open it in your chosen editing tool.

- Begin by entering your name and identifying number as shown on your tax return at the top of the form.

- Select the category of income for which you are claiming the credit, checking only one box: passive income, high withholding tax interest, financial services income, shipping income, dividends from a DISC, or other specified categories.

- In Part I, list the foreign country or U.S. possession where the income was sourced, along with the corresponding gross income from that country as per the category selected.

- Include deductions and losses in Part I. This may require attaching a statement to support any expenses you claim that are definitely related to the income reported.

- Complete the calculations for any other deductions, interest expenses, and losses as instructed in the form, ensuring to use the appropriate lines.

- In Part II, report the foreign taxes paid or accrued, ensuring the amounts are recorded in both foreign currency and U.S. dollars.

- Total the foreign taxes paid or accrued and carry the amount forward to Part III, where you will calculate the foreign tax credit using the totals from both Parts I and II.

- Finally, review the entire form for accuracy, then save, download, print, or share the completed document as needed.

Complete your documents online today and maximize your foreign tax credit eligibility.

Related links form

You can claim a foreign tax credit without filing the 2003 Form 1116 by using the simplified method if your foreign taxes are below a specific amount. In this case, you can report your foreign income directly on your tax return instead of detailing it on Form 1116. However, the benefits of capturing all eligible credits are often more pronounced when you file the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.