Loading

Get When To Use Tax Form 4137: Tax On Unreported Tip Income

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the When To Use Tax Form 4137: Tax On Unreported Tip Income online

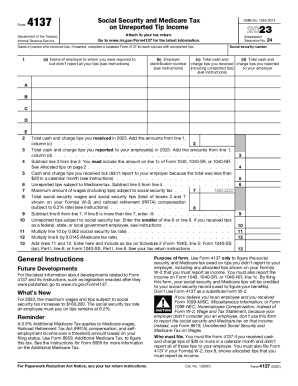

Filling out Form 4137 is essential for accurately reporting unreported tip income to the Internal Revenue Service. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring compliance and proper tax credit for your social security and Medicare contributions.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the person who received tips. If married, ensure to complete a separate Form 4137 for each spouse with unreported tips.

- In column (a), provide the name of each employer to whom you were required to report but did not report all your tips.

- In column (b), enter the Employer Identification Number (EIN) for each listed employer.

- In column (c), list the total cash and charge tips you received, including any unreported tips.

- In column (d), specify the total cash and charge tips you reported to your employer.

- Complete lines 2 and 3 by adding the amounts from column (c) and (d) respectively for all employers.

- Subtract line 3 from line 2 to determine the amount of unreported tips and include this on line 1c of Form 1040, 1040-SR, or 1040-NR.

- Calculate the social security wages and tips subject to taxation. Make sure not to exceed the maximum amount of $160,200.

- Multiply the appropriate unreported tips by the social security tax rate of 6.2% and the Medicare tax rate of 1.45% to figure the total tax owed.

- Add the calculated taxes to ensure accuracy before finalizing your form.

- Once completed, save any changes made to the form, and you may then download or print a copy for your records.

Start filing your tax documents online today for a smooth process.

Keep a daily tip record In addition to the information asked for on Form 4070A, you also need to keep a record of the date and value of any noncash tips you get, such as tickets, passes, or other items of value. Although you do not report these tips to your employer, you must report them on your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.