Loading

Get Is It Necessary To File New Mexico Form Pte As Well As Form Rpd ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Is It Necessary To File New Mexico Form Pte As Well As Form Rpd online

Filling out the Is It Necessary To File New Mexico Form Pte along with Form Rpd can feel overwhelming. This guide is designed to break down the process into manageable steps, ensuring that users can complete their forms accurately and efficiently online.

Follow the steps to complete the form online effectively.

- Click the ‘Get Form’ button to access the form in the online editor.

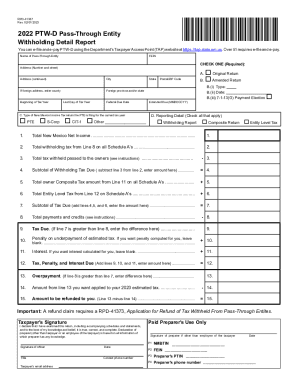

- Enter the name of the pass-through entity in the first section along with its federal employer identification number (FEIN). Make sure to check the one applicable to your entity type.

- Fill in the complete address of the business, including the street address, city, state, and postal/ZIP code. If you are using a foreign address, include the county and province/state as well.

- Indicate the beginning and last day of the tax year and the federal due date for the current tax year.

- Select the type of New Mexico income tax return your entity is filing for the current tax year by checking the appropriate box: PTE, S-Corp, CIT-1, or Other.

- Specify whether you are filing an original return or an amended return, and provide the type and date of the amendment if applicable.

- In the reporting detail section, check all applicable items such as withholding report, composite return, or entity level tax.

- Complete the financial sections by entering the totals for New Mexico net income, withholding taxes from all Schedule As, and tax withheld passed to owners. Follow the calculations as outlined in the form.

- Ensure that the tax due is accurately calculated, including any penalties or interest as applicable.

- Sign and date the form, providing your contact information and taxpayer's email address.

- If applicable, fill out the paid preparer's use section, ensuring that the preparer’s details are accurately documented.

- After reviewing all entries for accuracy, save your changes. You can then download, print, or share the completed form as needed.

Start filing your documents online today for a smoother submission process.

Individuals/entities who fall under the following criteria must file income tax returns. Gross income more than Rs. 2.5 lakhs - The gross annual income of an individual should exceed Rs. 2.5 lakh after applying deductions under various Sections of the Income Tax Act.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.